2020 Year End Update

In the year since the onset of COVID-19, the Coronavirus has reached all corners of the world and touched every aspect of our lives. The human and economic tolls have been unprecedented, but the pandemic has also shown our resilience, innovation, and adaptability. We have seen behavioral shifts in work, housing, and consumption, driven largely by technology.

Some changes that were already underway before the pandemic, such as the rise in e-commerce, were accelerated. Other changes were adopted as a result of the pandemic, like increased home food consumption and the ability to work remotely, which led to a migration to less dense, suburban markets. Some behaviors will revert once the pandemic is under control, but others may stick, leading to permanent shifts. While businesses and individuals adapted to work around COVID-19, it is clear that a sustained recovery will only occur when the virus is under control.

The number of daily new confirmed COVID cases in the US has finally started to decline after increasing for four months. However, the daily new case count remains at significantly elevated levels, more than at any point of the pandemic before the November and December holiday surge. Nevertheless, declining cases are a step in the right direction, with vaccines paving the way to recovery.

Market Update

After the Covid-19 pandemic forced a global economic shutdown that plunged the US into a sharp recession in early 2020, the segmented re-opening of the US economy led to early job gains. However, the recovery to date has been tepid, as the virus continues to spread. The rebound in employment gains seen at the start of the second quarter of 2020 steadily tapered throughout the third quarter, and in December, finally reversed course after a resurgence of the virus led to reimposed restrictions on non-essential businesses and social gatherings.

Source: BLS

The labor market lost 140,000 jobs in December, the first month of negative job growth since the initial shutdown in April. As of December, only about half of the 22 million jobs lost at the start of the pandemic had been recovered, leaving a loss of 9.8 million jobs. In early 2021, initial unemployment claims jumped back up to 965,000 after months of steady decline.

Despite the partial recovery experienced to date, the labor market continues to paint a picture of a struggling economy. Of those counted on unemployment, 3.4 million job losses have been categorized as permanent, almost triple the amount from December 2019. As of December 2020, those unemployed for six months or longer were 37% of the unemployed, representing almost 4 million workers. Lost jobs become harder to replace the longer businesses are shuttered and a portion of the long-term unemployed may never rejoin the labor force. The labor force participation rate plummeted to an all-time low of 60% during the pandemic.

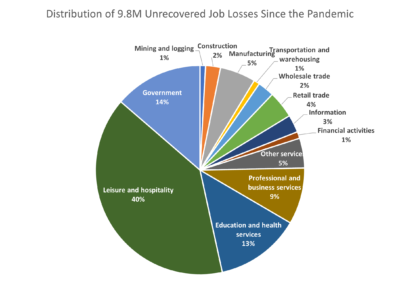

The economic impact has not been evenly distributed across industries. Given the restrictions on social contact to curb the spread of the virus, the service sector, including food service and accommodations, transportation, recreation, and health care, which typically involves in-person interaction, has borne the brunt of the impact. Unemployment in leisure and hospitality alone represents nearly 40% of the 9.8 million unrecovered jobs. State and local governments have shed 1.4 million jobs, representing an additional 14% of job losses.

Source: BLS

Across the country, state and local governments face revenue shortfalls estimated at $500 billion over the next three years. Without additional stimulus assistance from Congress, job losses will worsen, and the economic hardship of local governments will continue to compile.

On the other hand, industries deemed essential and many office jobs that have been able to shift to a remote working model have not been significantly affected. Many of these workers have remained employed and saw little change in wages. The US personal savings rate was 13% in November, which is significantly higher than the 7.5% savings rate before the start of the pandemic. The increase in personal savings is due, in part, to increased income from the various stimulus programs and to decreased spending on services, as many of those business operations have been limited from efforts to slow the spread of the virus.

A sustained economic recovery will depend on the ability to get the pandemic under control, and there are encouraging signs on that front. Vaccines have been developed at a record-breaking pace, with two vaccines already approved for distribution in the US. Vaccinations have already begun for healthcare and other essential workers, and for residents of long-term care facilities and the elderly. The initial rollout has faced challenges, however, the daily vaccine doses administered has increased from 300,000 at the start of January to over one million at the end of the month. As more individuals receive the vaccine over the coming months, we expect that the path to a sustained recovery will continue to become clearer.

There are indications that a stronger recovery could lie ahead as demand for manufactured goods has remained robust during the pandemic, and consumers are sitting on additional savings. Manufacturing, often seen as an indicator for the overall economy, has sustained eight months of growth following the initial contraction, with all six of the biggest manufacturing industries registering moderate to strong expansion in December. There may also be a demand spike for dining and other in-person services and travel experiences that have been put on hold or greatly reduced in 2020.

In the meantime, Congress passed an additional $900 billion stimulus bill in late 2020 and hinted at more spending aid to come. The latest package includes additional help for small businesses, direct stimulus payments to eligible individuals, extended and expanded unemployment benefits for those out of work, and an extension of the eviction moratorium. These stimulus measures are critical lifelines for many businesses and individuals whose livelihoods have been disrupted by the restrictions enacted to combat the spread of the Coronavirus.

Commercial Real Estate

Commercial real estate has also been impacted by the COVID-19 pandemic, resulting in reduced rental income and increased vacancies at many properties. Much like in the greater economy, various segments of commercial real estate have been affected differently, leading to varying transaction volumes and divergent asset pricing across asset types, with some sectors posting growth, while others declined.

Delinquencies for commercial real estate loans, which have been steadily trending downwards since the Great Financial Recession, jumped significantly in the second quarter of 2020, and have remained elevated, with hotel and retail reporting the highest delinquency percentages. To date, there has not been a significant volume of distressed sales. According to Real Capital Analytics, distressed sales only accounted for about 1% of all commercial property sales in the past two quarters. A partial explanation of the low volume of distressed sales is the increase in loan modifications and forbearances, which reduce or delay loan payments. This provides borrowers temporary relief, but does not address the underlying issue, and may indicate hardships down the road if the business environment does not improve.

Overall investment activity tumbled in 2020, as economic uncertainty caused buyers and sellers to diverge on pricing expectations, but has been gaining speed in the second half of the year. Interest rates declined at the start of 2020 and remain low, and financing remains available for certain asset types.

Multifamily has shown its resilience throughout the pandemic and is one of the leading sectors in commercial real estate. Nationwide, rent collections have remained solid, averaging 94% in the fourth quarter, according to NMHC’s survey of over 11 million apartment units. Housing is a high-priority, essential expense, so households will prioritize rent payments, choosing to delay or forego other discretionary expenditures. Furthermore, the stimulus payments, along with expanded and extended unemployment benefits, have undoubtedly helped renters who were adversely impacted by the pandemic continue to make rent payments.

Alpha Investing Strategy

While uncertainty remains, we are cautiously optimistic about the present outlook for commercial real estate and will continue to seek investment opportunities that we believe can achieve attractive risk-adjusted returns. Our strategy remains focused on working with experienced sponsor partners and targeting investments with downside protection and strong upside potential relative to risk. We will also remain focused on multifamily and senior housing, our preferred asset classes, but may selectively consider opportunities in other asset classes.

Within multifamily, we continue to focus on affordable, Class B, workforce housing in markets with strong employment and population growth. This product caters to “renters by necessity,” who represent more inelastic demand. Additionally, we look for opportunities to create value and upside by improving the physical asset, operations, or both. We are also targeting government subsidized housing, where a significant portion of rent is paid through government contracts, reducing collection risk. These housing programs have high renter demand and often have long waitlists, resulting in lower vacancy rates for these properties. Rental collections across the multifamily properties Alpha Investing’s network is invested in remains strong, averaging in the mid-90% range, in line with the national average.

In addition to multifamily, we continue to believe in the long-term fundamentals of senior housing and are actively seeking situational distress opportunities. The sponsor that operates all the senior housing properties Alpha Investing’s network is invested in implemented protocols to protect residents at the start of the pandemic, and began vaccinating residents in late December, shortly following the approved distribution of the vaccines. While Alpha Investing’s senior housing properties have seen occupancy declines and increased expenses like the rest of the sector, the near-term outlook is already improving with the properties seeing increased leasing velocity.

We continue to actively seek new investment opportunities and manage our existing portfolio. In the fourth quarter of 2020, Alpha Investing brought two value-add multifamily opportunities and two government-subsidized affordable housing investments to our network. Both value-add multifamily investments closed in the fourth quarter. Additionally, in December, one of our multifamily investments in Phoenix sold, following the successful execution of the value-add business plan that included exterior and interior unit renovations, which resulted in a 30% increase in rents and 40% increase in net operating income compared to acquisition.

Recent Transactions

Multifamily Asset Sale

Phoenix, Arizona

- Sale of a 1979-vintage, 488 unit Garden-style apartment community in Phoenix, Arizona upon successful execution of a value-add business plan after 20 months of ownership.

- Renovated approximately 30% of the units, achieving a 30% increase on new leases compared to acquisition, and improved operating efficiency, which resulted in a 40% increase in NOI compared to acquisition.

Multifamily Acquisition

Phoenix, Arizona

- A 1982-vintage, 199-Unit, Garden-style apartment community in Phoenix, AZ, located within the dynamic Arcadia submarket, which is considered one of the top places to live in the Phoenix MSA.

- Phoenix remains a top market in the western United States for job growth, which continues to drive demand for multifamily throughout the Phoenix MSA. Employment growth in Phoenix is being driven by a more diverse composition of industries, including healthcare, financial services, technology, and professional/business service firms.

- Well-positioned Asset Located in Prime Arcadia Submarket, considered one of the top places to live in the Phoenix MSA. The strength of Arcadia is driven by its proximity to major employment centers, robust dining and retail options, strong school systems, and easy access to other top submarkets in the MSA, including Scottsdale, Tempe, and Downtown Phoenix. The Property is located in the center of five prominent office submarkets, which combine for 40 million square feet of office space with approximately 180,000 office workers.

- The seller recently invested over $2.2 million into the Property, including installing washers and dryers to all units and renovating 25 units (13% of total). The Sponsor will continue the unit renovations, updating to their brand design, and refreshing the exterior to further improve cash flows.

Multifamily Acquisition

Franklin, Ohio

- A 110-unit, Class C, workforce housing property in Franklin, OH, which is located 15 minutes south of Dayton, OH on the I-75 corridor between Dayton and Cincinnati.

- The Property offers the most efficient and affordable units in the market, with a mix of studios and two-bedrooms that caters to a wide range of renters. As a result, the Property is 97.3% occupied and has strong demand. The efficient unit size of the Property allows for rent increases, while maintaining rents that are below market and highly affordable, at approximately 22% of median resident income.

- The acquisition will be financed with attractive, ten-year, 3.79% fixed-rate, agency financing at 80% loan-to-value with three years of interest only and a step-down prepay. Year 1 debt service coverage ratio is projected to exceed 2.0x.