US Economic Outlook

Inflation reached its highest level in over 40 years during 2022, driven by a combination of the massive Covid-19 assistance funds poured into the economy, supply chain issues, Russia’s invasion of Ukraine, and spiking oil prices, among other factors. At the beginning of 2022, the Fed reversed course on its position that inflation was transitory and began raising rates for the first time since December 2018. Throughout the year, the Fed played catch up in its efforts to rein in inflation that remained stubbornly high and shattered expectations for how aggressively it would raise interest rates. All told, the Fed raised its benchmark interest rate by 425 basis points in 2022, taking the Federal Funds rate to 4.25-4.50%, its highest level since 2007.

Throughout the year, the labor market remained tight, which gave the Fed confidence to continue aggressively raising interest rates. Unemployment has hovered in a range between 3.5-3.7% and wage growth has remained robust. Companies have continued to find it difficult to fill open positions and have offered higher wages to incentivize workers to stay or attract new hires. Bolstered by the labor market, consumer spending has, thus far, stayed at healthy levels.

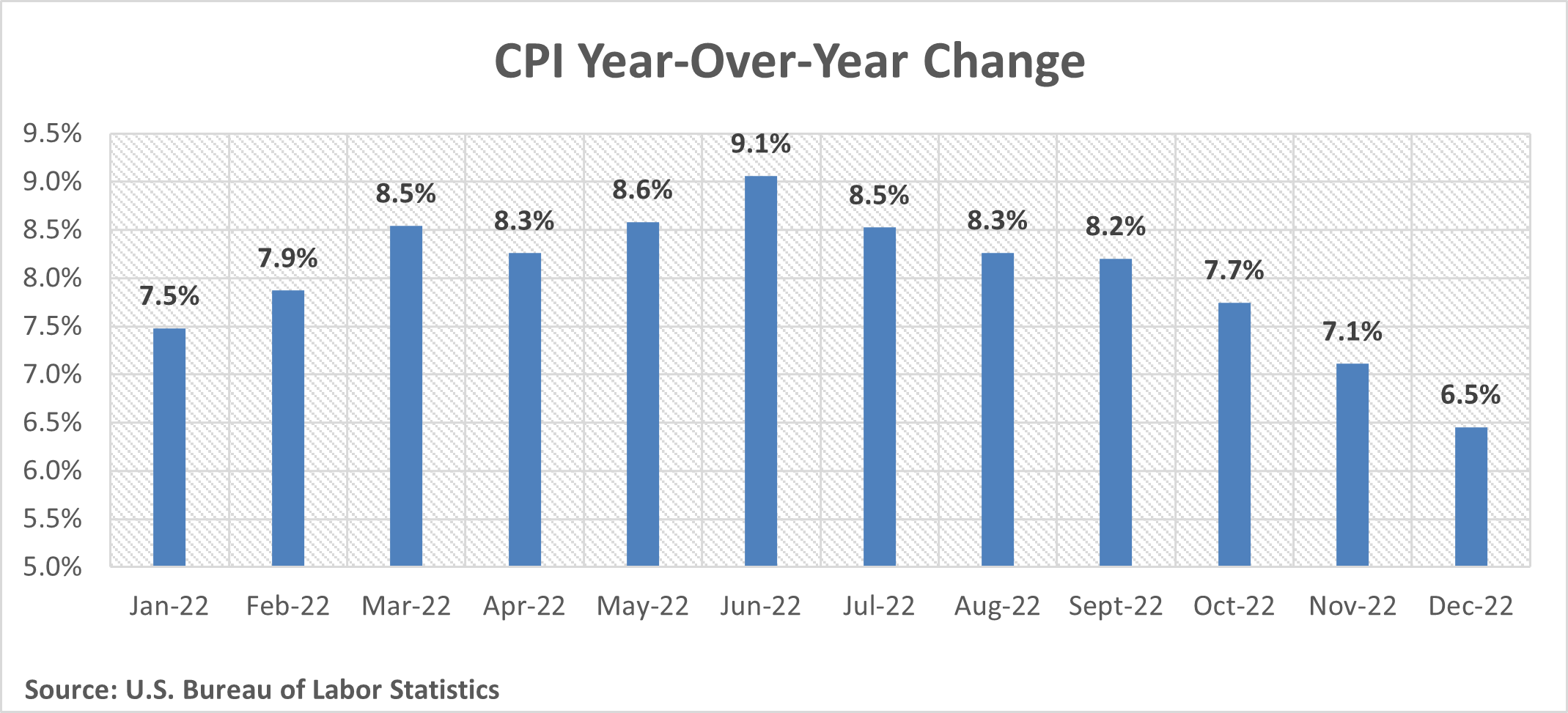

The impacts of the Fed’s aggressive monetary policy shift are now beginning to take hold. Recent data suggests that inflation is easing from its highs experienced in the first half of 2022. Inflation peaked at 9.1% in June, with December year-over-year CPI moderating to 6.5%, the lowest inflation reading since October 2021.

Rising interest rates have reverberated throughout some of the sectors the Fed believed were problematic in stoking inflation. Although the labor market remains strong, the number of job openings has come down from its highs. Additionally, while job growth is steady, the pace of growth slowed throughout 2022. A balanced supply and demand of workers should ease pressure on wage gains. The PCE (Personal Consumption Expenditure) index, the Fed’s preferred inflation measure, is also showing signs of slowing growth in consumer spending. Lastly, housing prices grew at their lowest rate in two years. November 2022 broke the 21 month streak of double digit year-over-year price increases as rising interest rates have made purchasing a home less affordable.

The Fed’s actions are beginning to show signs of their intended effect. However, inflation remains well above the Fed’s 2% inflation target. Additionally, cracks have begun to emerge in the health of the consumer. The personal savings rate has continued to dwindle as inflation eats into savings individuals were able to accumulate throughout the pandemic. At the same time, consumer credit has continued to reach new highs, as consumers purchase more on credit. Slowing growth in spending in addition to record usage of credit suggests that the average consumer is becoming increasingly constrained.

While the Fed seeks to achieve a “soft landing” by raising interest rates to slow the economy just enough to get inflation under control, it is an increasingly precarious balance. Inflation is still significantly higher than the Fed’s target, while the average consumer is already becoming constrained. Presently, the Fed is willing to trade off a period of slower growth and softening labor conditions to get inflation under control. The current forecast includes additional, but less drastic, rate increases in 2023, which translates to rates remaining at elevated levels, but increasing more slowly. The December projection for the Fed Fund’s rate was 5.1% by the end of 2023, approximately 75 basis points higher than the end of 2022.

The Commercial Real Estate Landscape

Elevated interest rates appear to be here to stay for 2023, which will likely reinforce downward pressure on asset values. Buyers and lenders have begun to adjust their underwriting for a sustained higher cost of debt and are constrained by higher debt service payments, resulting in lower loan proceeds. There remains significant price stickiness in the transaction environment due to the bid-ask spread between buyers and sellers. Owners that are not pressured to sell will continue to hold their assets for a more favorable capital markets environment. However, for transactions that are trading, there has already been some downward pricing adjustment and rising cap rates. We believe we will see more asset sales in 2023 with opportunities to transact at higher cap rates compared to 2021 and 2022 as owners face debt maturities.

In the near term, commercial real estate continues to face a more challenging operating environment. The increased cost of debt is eroding cash flow, reducing investor returns. Economic uncertainty has caused declines in both business and consumer confidence, which has led to changes in behavior. In December, the Small Business Optimism Index hit its lowest mark in six months, with inflation and hiring difficulties being the two largest concerns. As inflation compresses operating margins and hiring difficulties make expansion harder, businesses are slowing hiring, reducing their headcount, delaying decisions on long-term leases, or downsizing their overall real estate footprint as they wait out the near-term uncertainty. Although consumer confidence increased in December, due to the recent decline in gas prices, the Expectations Index (short-term economic outlook) is hovering around a level associated with a recession. Consumers are reluctant to make big decisions, including plans to purchase homes and big-ticket items.

The economic uncertainty has begun to be felt in commercial real estate assets across the country. Overall, there has been a pullback in demand which has resulted in declining occupancy, increasing delinquency, and slowing rental growth. Businesses and consumers alike are content to stay put and wait out the uncertainty. With demand declining, owners and operators will face more competition to attract and retain quality tenants. This could result in concessions, rising vacancy, and declining rental growth. At the same time, we are still facing a high-cost environment. Expenses such as labor, utilities, and insurance, continue to remain elevated. Despite a challenging near-term outlook, we continue to believe in the favorable medium-to-long-term outlook for commercial real estate.

The Alpha Investing Strategy

Alpha Investing continues to believe in the fundamentals of investing in commercial real estate. However, the asset class faces near-term challenges. Economic uncertainty has resulted in weaker demand and rising delinquencies, which has slowed revenue growth. At the same time, operating expenses and borrowing costs have risen, reducing margins and cash flow.

Despite the current uncertainty, Alpha Investing believes there are strategies to navigate this environment. We have shifted our focus to pursuing investments that have durable, in-place cash flow where the going-in yield is higher than the cost of debt. On the financing side, we are generally using lower leverage compared to 2021 and 2022, and our preference is to acquire assets using fixed-rate financing. Where fixed-rate financing is unavailable or not optimal at acquisition, we will seek to purchase rate caps for floating rate debt to lock in the maximum cost of borrowing at acquisition.

Additionally, on the acquisition front, we are starting to see sellers capitulate. These sellers are often selling out of necessity due to external factors, such as upcoming debt maturities, length of hold or an inability to effectively operate in the current environment. In these cases where the seller is serious about transacting, we are seeing pricing and cap rate adjustments that account for the increased cost of financing.

We will continue to target the strategies mentioned above, which we began employing in the second half of 2022. We continue to engage with new and existing sponsors to evaluate investment opportunities. While we see the upside potential in many opportunities, we are cognizant of the increased downside risks stemming from rising rates and economic uncertainty. We remain disciplined in our underwriting, focusing on asset fundamentals and downside protection. Many business plans will not meet our criteria and we will be patient for the right opportunities.

Like the rest of the industry, we are facing the near-term operating challenges discussed above in our existing portfolio. As owners, we recognize the window to sell assets at the significantly compressed cap rates we saw over the past few years has effectively closed. We therefore expect to hold most of our investments over the next 12 months, if transaction conditions remain the same. In the meantime, we are actively working with our sponsor partners to grow and stabilize NOI and preserve liquidity, while remaining diligent in assessing the capital markets and exploring sales opportunities when they present themselves.