Alpha Investing wrapped up 2018 by participating in the acquisition of two multifamily investments in December. The first is a high-rise apartment building located 20 miles from Manhattan, the second is a garden-style apartment building located in the heart of the Greater Bay Area. We also made our third investment in a commercial real estate debt fund that is managed by a highly established NYC-based commercial real estate firm.

As we look ahead to 2019, we continue to view real estate as an asset class with attractive risk-adjusted returns, particularly amid increased volatility in the broader markets. Fundamentals remain solid with continued US economic growth and healthy job creation. However, we are in a more mature phase of the market cycle as the US economic expansion is nearing ten years and rents and property values have already risen significantly. We are no longer in an environment where a rising tide raises all boats. As such, our investment strategy in this environment is to focus on asset fundamentals, identify assets with solvable issues and seek to mitigate downside risk. First and foremost, we align with high-quality sponsors with experienced principals who have strong track records, deep debt relationships, and extensive industry relationships. These sponsors and/or their principals have transacted in billions of dollars of real estate. From these partnerships, we will continue to seek targeted real estate investment opportunities with compelling risk-adjusted returns while remaining patient and disciplined in our approach.

2018 Review

The US economy finished 2018 with robust growth continuing its nearly ten-year long economic expansion. Real GDP is forecasted to have grown at an annual rate of approximately 3%, the fastest pace this recovery cycle since the Great Recession. Unemployment remains at a nearly 50-year low and is expected to fall even further in 2019. The strong performance prompted the Federal Reserve to raise interest rates four times in 2018, continuing its path to monetary policy normalization. The latest December rate hike increased the target range to 2.25%-2.5%, the highest level since spring 2008.

Although the US economy comes off a strong 2018, the year ended with significant volatility in the equity and bond markets. The Dow Jones Industrial Average and S&P 500 experienced their worst December performances since 1931 and finished the year with losses of 6.2% and 5.6%, respectively, the biggest annual declines since 2008. The bond markets also tumbled in the fourth quarter with the 10-year Treasury dropping to 2.69% at year-end after hitting a seven-year high of 3.26% in October.

Navigating 2019

Looking ahead to 2019, growth is expected to be more moderate and subdued. Some factors that could lead to slower growth include the effects of the stimulus package wearing off, a tightening US financial market and a slowing global economy. The Federal Reserve revised its 2019 growth forecast down slightly to 2.3% from 2.5% and is signaling fewer rate hikes in the coming year. An environment with slower growth combined with the impacts of a tightening financial market, including rising interest rates, means returns are likely to be lower compared to earlier in the cycle.

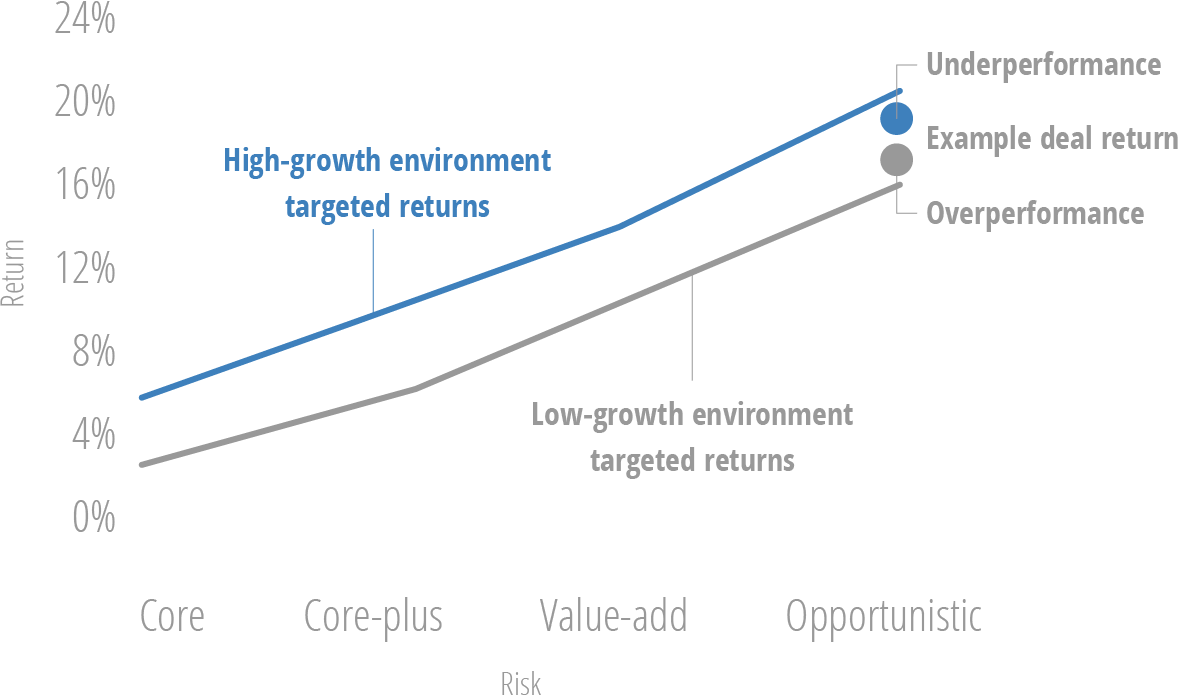

With all investments, there is the concept of risk and return tradeoff. Typically, the greater the risk, the greater the return. Conversely, the lower the risk, the lower the return. In real estate, the risk return spectrum is sectioned into four buckets: core, core-plus, value-add and opportunistic. Investments can loosely be classified into the four risk spectrum buckets by physical attributes such as quality, age and location of the real estate. And although there aren’t fully objective rules for these classifications, the fundamental distinctions between the four risk buckets are the stability of current income, future growth potential, the use of leverage, and the associated risk based on these factors. Below are a set of general guidelines for these classifications:

Core investments sit on one end of the spectrum with lower risk and returns. These are typically well-maintained buildings with stable long-term occupancy. This generally translates to little or no capital improvements and a stable rental income stream, thereby reducing risk. Core investments are more likely to achieve targeted returns due to the lower amount of risk involved.

On the opposite end of the risk spectrum are opportunistic investments, which have the most risk and typically higher associated returns. An example would be a ground-up development where risks include entitlement, development and lease-up. While projected returns are high, due to the high amount of risk involved, there is a greater chance the investment may not achieve projected returns.

How should investors think about yield in today’s environment?

In a slower growth, rising interest rate environment, a deal that generated an 18% return earlier in the recovery cycle may now yield a 15% return due to less revenue rent growth and higher interest expenses. When comparing the two returns in this example where the investment is the same but market conditions are different, it is important to note two things. The decrease in return does not mean the amount of risk in the deal has decreased, nor does it necessarily mean the deal is less attractive because the return is lower. That is because the absolute return of the investment, in and of itself, doesn’t tell the full story. The relative return is also an important measure and consideration.

If earlier in the cycle this deal generated an 18% return when similar investments in the market with similar risk were making 20% returns, then the 18% return underperformed the market. On the other hand, if the deal now generates a 15% return, but investments with similar risk are only generating 13% returns, then the 15% return is outperforming the market. The difference between the absolute return of an investment and returns of similar investments in the market is the relative return. So while 18% is higher than 15% in absolute terms, in this example, the 15% return represents a better relative return.

It is always important to look at relative returns versus absolute returns, but it becomes imperative in markets where yield is compressing so that investors don’t overexpose themselves to risk while chasing yield. In a high-growth environment, a value-add investment may have achieved a 16% return. In a lower-growth environment, an investment generating a 16% return may have characteristics and risks of an opportunistic investment.

The Alpha Investing Strategy

As we look ahead to 2019, we believe the moderating economy will impact the commercial real estate industry but believe that commercial real estate will continue to offer attractive relative risk-adjusted returns. We will remain disciplined in our underwriting and continue to execute on the strategy we outlined in our 3Q18 newsletter, which includes focusing on asset fundamentals, identifying assets with solvable issues and seeking to guard against the downside. Our recent transactions serve as case studies for this strategy.

New Rochelle, NY Multifamily Acquisition

Alpha Investing participated in the core-plus acquisition of a 588-unit, 40-story Class A high-rise apartment building located 20 miles north of Manhattan in the city of New Rochelle. At acquisition, the property was 95% occupied, and is one of a few luxury rental buildings in New Rochelle. It sits on-transit with 30-minute direct train access to midtown Manhattan and ~50% of the property’s tenants are Manhattan commuters. New Rochelle itself launched a $4 billion redevelopment campaign to develop hotel, office, retail and residential to create a 24/7 urban community. The property is located at the epicenter of the Master Plan.

Our sponsor group acquired the property for ~$260 million in an off-market transaction that resulted in an attractive going-in cap rate of 5.55%, which was an estimated 50-100 basis points above market. The above-market acquisition cap rate combined with attractive long-term fixed-rate financing is expected to provide current cash yield of approximately 6%, with an opportunity to expand income through implementing light upgrades to approximately 40% of units as well as improving operating efficiencies.

Hayward, CA Multifamily Acquisition

Alpha Investing participated in the value-add acquisition of a 150-unit, garden-style apartment building located in Hayward, CA. Located in the Easy Bay, Hayward is home to almost 2.5 million people and is at the heart of the greater San Francisco Bay Area. The property was 94% occupied at acquisition and is located just over one mile from downtown Hayward – an area in the midst of a revitalization. Our sponsor partner plans to implement a strategic value-add program by adding washers and dryers in-unit, laying new flooring, improving cabinetry, upgrading appliances and adding new countertop treatments. In addition, the sponsor will enhance the property’s common areas.

Our investment was part of a syndication of the General Partner equity and will be entitled to a 25% pro rata share of the sponsor’s promote. This means that above certain return thresholds, Alpha investors will receive more than their pro rata share of returns, which increases the return potential of the investment and makes it more attractive on a risk-adjusted basis.

Our equity investments generally fall into the core-plus or value-add buckets. In both classifications, we seek opportunities with characteristics that can mitigate downside risk. For the New Rochelle acquisition, we believe that the long-term fixed-rate debt, the proximity to a durable economy, and the age and quality of the asset are all very attractive attributes that reduce downside risk. For the Hayward acquisition, we believe the proposed rent growth is well-supported by demographic data and believe that the unique microeconomic conditions of Hayward will somewhat insulate the property from broader market conditions in a downturn. In both cases, we placed strong emphasis on the quality of our sponsor partners, whom we believe have the requisite experience to navigate a down market.

Commercial Real Estate Debt Fund

In addition to our equity investments, we also participated in a commercial real estate debt fund. By virtue of being debt, this investment carries less risk than our equity opportunities. Furthermore, it is diversified across a portfolio of 15-20+ loans at any given point, substantially reducing concentration risk. Lastly, the fund is run by a highly established NYC-based firm that has originated billions of dollars of commercial real estate loans over 50 years without ever suffering a loss of principal.

In line with our discussion of risk versus returns, the lower risk of this investment does impact the return potential. Interest income doesn’t receive the same preferential tax treatment as rental income from equity deals, and the fund isn’t expected to provide an element of appreciation in its return. However, the investment is expected to yield low double-digit returns and is much more liquid than equity deals. The added benefit of liquidity may presently be of greater value to investors given increased uncertainty in equities across asset classes. All told, this commercial real estate debt fund has by far been the most popular investment within our network. We believe the return potential is very attractive relative to the risk, and we expect to place increased emphasis on this investment in 2019.

We will continue to seek opportunities that align with our investment strategy and have compelling risk-adjusted returns, while remaining vigilant in our underwriting to guard against the downside.