US Economic Outlook

In early 2024, the Federal Reserve would have likely been pleased with the results from the most recent economic reports. The labor market and the consumer purchasing power it has supported have both continued to cool while the unemployment rate remains at a healthy level. Although inflation is still higher than desired, the economy ticked along well for most of the first quarter. However, concerns around tariffs and their impact began to reverberate throughout the economy. Furthermore, GDP contracted for the first time since 2022, driven by a surge of imports at the end of the quarter, before tariffs went into effect.

Activity in the labor market remained steady to start the year. Following downward revisions for each month of the quarter, an average of 137.3k jobs were added per month during Q1 2025, below the 2024 average of 186k, but still indicative of a healthy labor market. The unemployment rate ticked up to 4.2%, a slight increase from the end of last year, but still below historical norms. Wage growth continues to outpace higher than desired inflation, but the gap between the two has shrunk.

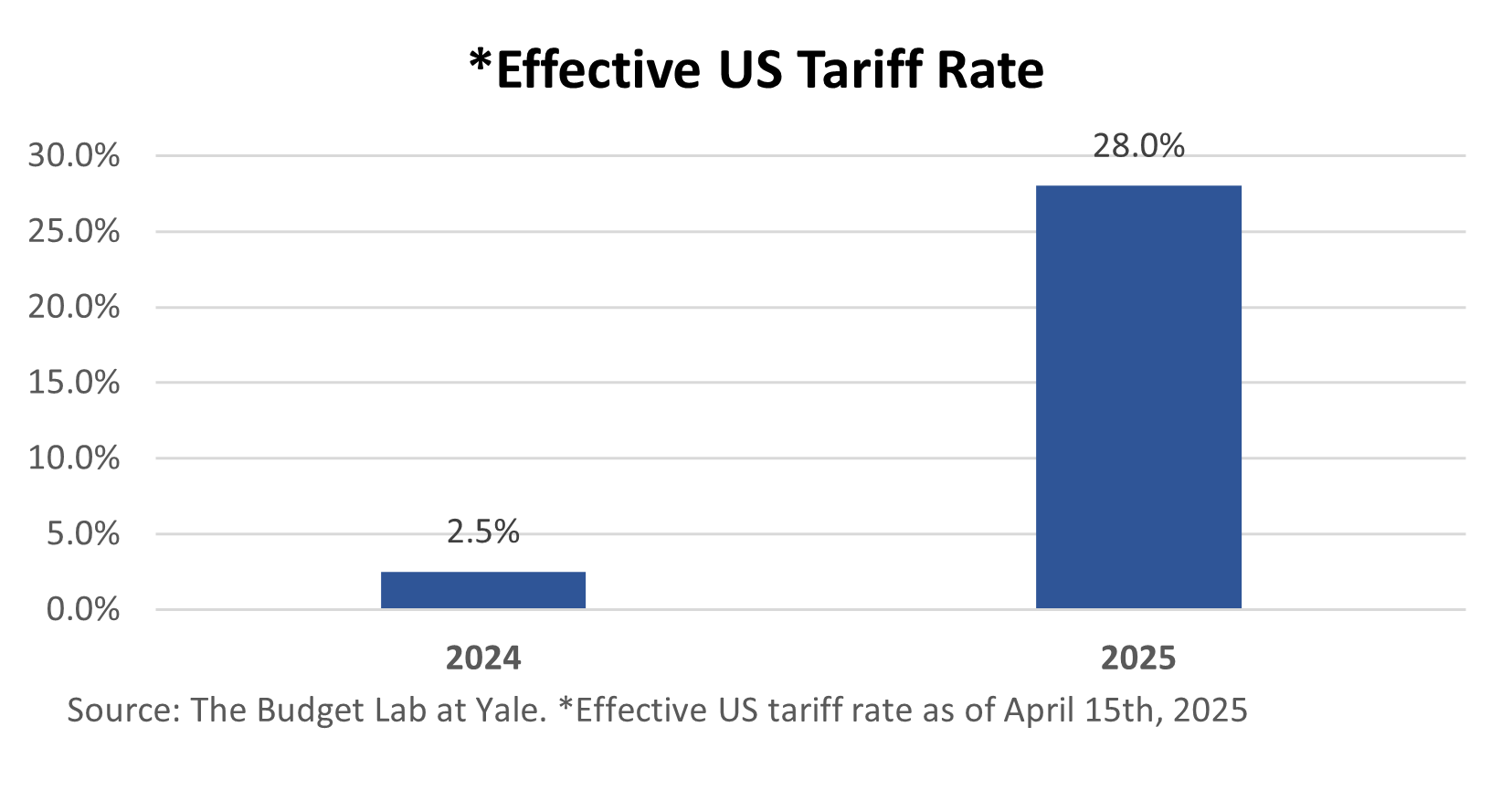

The United States made the most monumental change to its trading policy in more than a century. Inclusive of the tariffs that went into effect in early April, estimates of the new effective tariff rate range between 22% to 28%, reflecting an approximately tenfold increase relative to 2024’s average effective tariff rate of 2.5%. At the time of this writing, there is a blanket tariff of 10% on most countries, although some sectors are currently exempt. However, there is a possibility that those exemptions may lapse soon. China is a notable exception to the tenuous pause, as the United States and China have exchanged escalating retaliatory tariffs. This may continue to be a fluid and dynamic situation, which has already resulted in significant economic uncertainty.

Although the first quarter largely showed steady economic readings, there were potential signs that the news from the tariffs were beginning to be felt throughout the economy. Consumer sentiment fell each month in Q1 and hit its lowest reading since November 2022. Fears surrounding the impact of tariffs and trade wars led to plummeting outlooks on business expectations, personal finances, inflation, and unemployment. In addition, retail sales moderated more than expected during the quarter as recent developments impacted consumer spending patterns. At the beginning of the year, it was expected that inflationary pressures would remain in services due to robust demand. However, recent retail sales suggest that cost pressures have led to a shift in spending on goods to lock in lower prices. It is unclear whether this is a short-term trend or if there will be a larger change in consumer spending habits should prices remain higher.

Although the first quarter contained economic data that would have been out of the Fed’s playbook for achieving a “soft landing”, tariffs and potential trade wars threw a wrench into those plans. The timeline for resolving those issues is unknown and the Fed may face additional challenges in achieving its dual mandate due to the potential for rising inflation and slowing growth. The Fed is likely to stay the course of waiting to change its monetary policy until there is clarity regarding the risk to rising inflation and/or weakness in the unemployment rate.

The Commercial Real Estate Landscape

Entering 2025, the commercial real estate sector expected to see some headwinds subside as rising costs moderate, excess supply is absorbed, new construction cools, and interest rates potentially continue their recent decline. However, waning business and consumer confidence present new challenges for operators. It is unclear how rising prices and slowing consumer confidence will counteract or even fuel the headwinds that were expected to slow during the year. In addition, the Fed will maintain a cautious stance in regards to monetary policy until the downside risks can be assessed, adding further uncertainty to the outlook for any additional interest rate relief.

Both the index for business and consumer sentiment rapidly declined as the tariff and trade war situations developed. Future outlooks for inflation, financial health, and unemployment all deteriorated in the first quarter. In times of economic uncertainty, individuals and businesses often hold off on making big purchases such as expanding their real estate footprint or moving into an apartment, which may lower overall demand for commercial real estate. Should these concerns continue, this could put further downward pressure on rents at a time when the supply pipeline has not been fully delivered. Many renters are considered renters by necessity, as they remain in the renter pool due to financial constraints. They also have fewer options to move into a more affordable unit to save money. Rising inflation and unemployment may render some tenants unable to make rental payments, decreasing economic occupancy for operators. In addition, bottom lines may be further eroded as increases in operating costs may not be offset by revenue growth.

The expectation at the beginning of 2025 was that the Fed would cut rates less times than previously hoped for. At this time, the Fed is faced with the prospect of rising inflation and slowing growth, which challenges both aspects of its dual mandate. There would need to be greater clarity that the risk to inflation was subdued or that there was enough pain in the labor market for the Fed to cut rates.

As a reminder, there is not a one-to-one relationship between the Fed funds rate and the 10-year Treasury yield. The Fed funds rate is a short-term rate set by the Federal Reserve and charged by banks to borrow from each other overnight. The 10-year Treasury yield is the interest rate the US government pays to borrow money for ten years and is considered to be extremely low risk. Importantly, it is a long-term yield. It is also a benchmark for long-term borrowing costs, including mortgages and corporate bonds. The US Treasury sells bonds via auction and yields are set through a bidding process. The 10-year Treasury price and yield are influenced by fiscal policy, investor expectations for economic growth and inflation, and to an extent, the Fed’s monetary policy. Yields tend to rise when confidence is high as there is less demand for a safe investment. Conversely, yields tend to fall when confidence is low as there is more demand for safe investments.

Since the rate tightening cycle began, there has been significant volatility in the 10-year Treasury yield as economic data has been mixed and there has been uncertainty surrounding economic growth, inflation expectations and monetary policy. However, the first quarter saw especially drastic swings in the 10-year Treasury yield. Yields were initially lowered as investors sought haven in the treasuries but longer-term uncertainty regarding US trade policy, economic conditions, and monetary policy have resulted in volatility.

There was positive news on the transaction front as Q1 CRE sales volume grew 17% year-over-year. However, total transaction volume will likely remain constrained until there is greater stability in the capital markets. Concerns about slowing economic growth and rising inflation will likely need to be clarified before such stability returns.

The spread between interest rates on maturing loans and new originations today remains a significant challenge for owners of commercial real estate. Average interest rates on mortgages originated in 2024 were nearly 200 basis points higher than mortgages maturing in 2024. Over the past two years, lenders have worked with borrowers on loan modifications that include maturity date extensions to give properties more time to improve NOI and avoid taking losses if forced to sell at initial maturity. An estimated $270 billion in loans were extended from 2023 to 2024. This trend will likely continue in 2025. While the volume of loan modifications, including maturity date extensions, has been substantial, it pales in comparison to the estimated $1 trillion of commercial real estate mortgages that are expected to mature in 2025. A further $4.5 trillion in commercial real estate mortgage maturities are expected over the next four years. Managing through this level of loan maturities is further clouded by economic uncertainty and downside risks to rising inflation and unemployment.

The Alpha Investing Strategy

Monetary policy remains in restrictive territory, as the Fed funds rate remains 425 bps higher than before the tightening cycle. The current operating and transaction environments remain challenged for commercial real estate. Although Alpha Investing has significantly slowed our transaction pace since the current rate tightening cycle began, we still believe in the medium- to long-term fundamentals of commercial real estate. In particular, we believe senior housing and a targeted multifamily tax-abatement strategy continue to be compelling investment opportunities due to the strong asset fundamentals.

We continue to evaluate opportunities for new acquisitions, seeking to acquire fundamentally sound real estate with outsized upside potential relative to the downside risk. In the current high-interest rate environment, Alpha Investing has focused on acquisition targets that have maintained an attractive risk/return profile. This includes asset types and strategies that have high in-place yield with durable in-place cash flow, and utilizing fixed-rate financing, when available, to offer downside protection. While we are starting to see movement on cap rates, cap rates generally have not widened enough to offset interest rate increases. We believe it is highly unlikely that market cap rates will widen as much as interest rates have risen, resulting in reduced investor returns. Our specific investment strategies within our target asset classes, however, allow us to create that additional spread.

While the fundamentals for senior housing are strong, the asset class is an operationally intensive business with lower operating margins. Unlike most CRE asset types, senior housing ownership remains fractured with many small mom and pop operators, who may lack the knowledge, ability or scale to efficiently operate their assets.

We continue to find opportunities in senior housing that meet our investment criteria by partnering with our experienced senior housing operators. We have seen in-place acquisition cap rates, or cap rates that can be achieved on “day 1” of ownership in the high single digits to low double digits. These yields are significantly better compared to other asset types and offer strong in-place cash flow with the opportunity to further improve yield with the right business plan and an experienced operator.

While multifamily has faced several challenges in recent years, medium to long-term fundamentals remain strong. We believe our targeted multifamily tax-abatement strategy is compelling, as the tax abatement adds 100-200 basis points of yield, or value-creation, at acquisition. These investments are financed with 10-year, fixed rate debt, which provides holding power beyond the wave of new supply to capture the asset class’s strengthening fundamentals.

We continue to evaluate other asset classes and investment strategies. One specific area that we find compelling in the current environment is the STNL (Single Tenant Net Lease) space. Tenants are responsible for the majority of operating expenses and typically sign leases with 10 – 20+ years of term. Acquiring such properties, while utilizing lower leverage and fixed rate debt can result in stable and predictable cash flow. However, prudence must be used when evaluating the credit quality of the tenant. With that said, many tenants have investment-grade credit ratings from ratings agencies such as Moody’s or S&P. As such, we believe there are opportunities within this space that make particular sense in a time of uncertainty and are actively seeking to participate in such an acquisition.

Like the broader commercial real estate sector, a subset of our existing portfolio has floating rate debt with near-term maturities. We continue to work to secure holding power for those investments through loan modifications and additional capital injections. Across our entire portfolio, we remain focused on optimizing asset operations and improving NOI to maximize value.