Economic Outlook

US GDP growth is expected to slow, driven by inflation. The Federal Reserve (the Fed) has the difficult task of taming inflation, while not causing a recession by raising interest rates too quickly or not providing enough liquidity to capital markets.

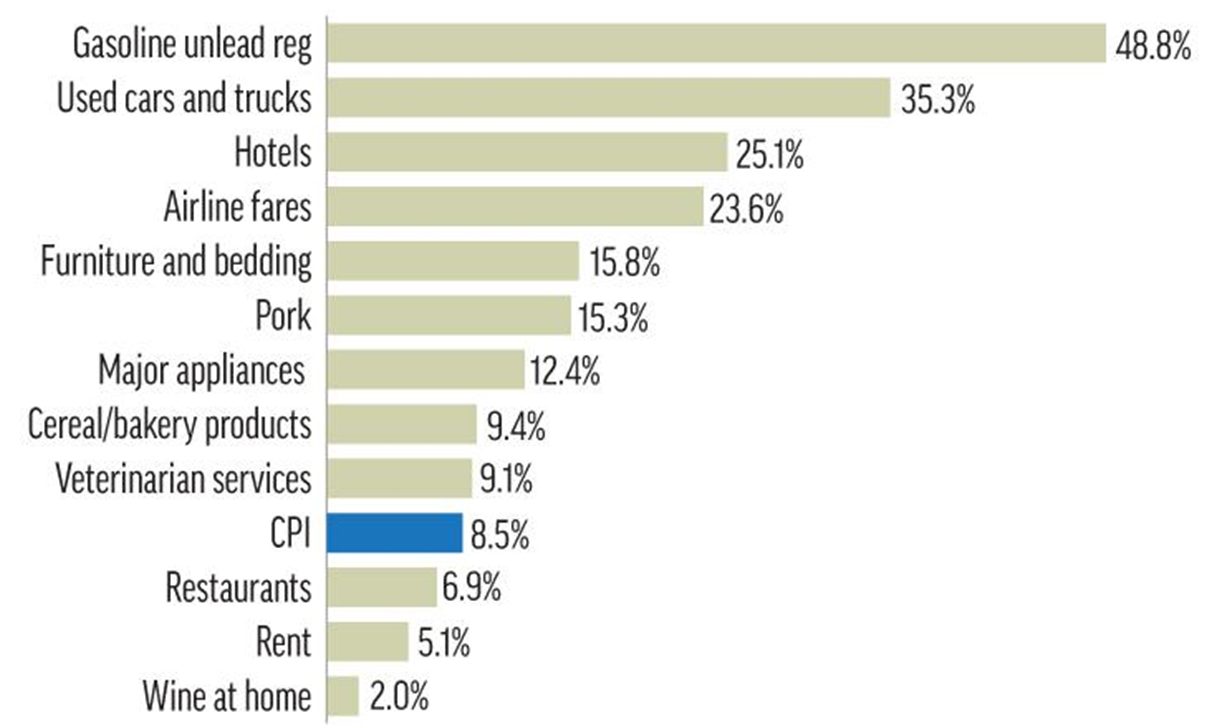

Inflation continues to increase at high historical rates. The Consumer Price Index (CPI) rose 8.5% year-over-year in March, the highest increase since 1981. The increase was driven by energy, shelter, and food. Core CPI, which excludes food and energy, rose by 6.5% year-over-year.

March 2022 Annual CPI change

Source: Bureau of Labor Statistics by The Associated Press

Inflationary pressures throughout the pandemic have been caused by both the supply and demand sides. There has been unprecedented demand for durable goods, led by record amounts of stimulus and a reallocation of spending from services to goods. At the same time, the global supply chain has been hampered by COVID-related issues, including labor, production, and inventory bottlenecks, as well as high transportation costs. The surging demand, coupled with supply chain disruptions, have resulted in the elevated levels of inflation seen today.

While the labor market has steadily regained jobs lost at the start of the pandemic, driving the unemployment rate down to 3.6% in March, the economy is still 1.6 million jobs short of pre-pandemic levels. Furthermore, the quits rate is at historic highs and there were five million more job openings in February than unemployed workers, or 1.8 jobs available for every unemployed worker. The low unemployment rate, high quits rate, and high number of job openings suggests the issue is a lack of workers. The competition for workers has contributed to rising wages. To date, the increase in wages has not been enough to entice significantly more people into the labor force. Additionally, the wage growth has not kept up with the pace of inflation, meaning real wage growth has been negative, eroding consumer purchasing power.

In an effort to address elevated inflation levels, the Fed raised the Fed funds rate by 25 basis points in March and signaled it would soon begin reducing its balance sheet. It was the first rate hike since December 2019, and the Fed has indicated there will likely be six additional rate hikes throughout the year.

By raising rates and reducing the money supply, the Fed is hoping to curb demand and thereby relieve some inflationary pressure. Demand, however, is only half of the equation. Supply chains continue to be stressed. The conflict in Ukraine has regrettably dragged on without a clear timeline for a peaceful resolution, and has further exacerbated supply chain issues, particularly for food and energy.

Commercial Real Estate

Historically, commercial real estate has been viewed as a hedge against inflation due to rents and property values increasing during inflationary periods. Although that is generally true, the asset class faces potential headwinds, with some property types better prepared to navigate those challenges.

The commercial real estate sector is also dealing with increased costs due to shortages in both available workers and materials in addition to rising interest rates. Operationally intensive investments like senior housing or projects that require significant renovations, have exposure to rising wages driven by a shortage of workers. Additionally, strong demand for capital projects coupled with inventory shortages has resulted in rising material costs. These elevated costs have the potential to reduce returns if revenue growth does not outpace expense growth.

Despite the increasing cost environment, certain property types have strong underlying fundamentals that can help weather the headwinds. Multifamily, single-family rentals, and industrial have all performed well over the course of the pandemic, driven by favorable supply and demand imbalances. Multifamily rents grew by 13.5% overall in 2021, while single family rents grew by 7.6%, with certain markets for both asset types growing over 20%. The strong rent growth in multifamily and single family overall, has outpaced expense growth for the same period, leading to increased net operating income. Even if rent growth moderates, the fundamentals driving multifamily and single-family rentals remain attractive, as supply has not kept pace with demand. Home values have also increased sharply over the last few years, which coupled with rising rates, make the cost of homeownership even less affordable. The prohibitive cost of homeownership will keep more of the population in the renter pool, driving demand for both multifamily and single-family rentals.

Rising rates affect all property types, most directly in the cost of borrowing. For assets with existing loans, rising rates affect floating rate debt as the monthly debt expense is tied to a variable rate that increases when rates rise. If revenues stay the same, the increased debt service costs will reduce remaining available cash flow to investors. Assets with existing fixed rate debt with term remaining, will not experience increased borrowing costs, as the interest rate on those investments will remained fixed.

The less direct, but meaningful impact of rising rates is on asset pricing. Cap rates across all property types have steadily compressed over the last 18 years as interest rates declined and remained at historical lows. The declining cap rate has driven significant asset value appreciation over that same period. Historically, cap rates have followed interest rates in the long term, although shorter periods have bucked the trend. This is because investor returns are based upon the spread between cap rates and interest rates. If cap rates remain flat, rising rates will reduce the spread or investor return. If cap rates continue to compress, as they did during the 2016–2018 rising rate environment, the spread will be further eroded. The ten-year treasury has risen sharply in 2022, hitting a peak of 2.9% in April, up nearly 1.4% from year-end 2021. During this time, cap rates have largely remained flat.

Alpha Investing Strategy

We continue to believe in the long-term fundamentals and benefits of owning commercial real estate, but currently the asset class is facing near-term uncertainty. The ten-year treasury rate has risen sharply in the first quarter of 2022. To date, we have seen little adjustment on cap rates and asset pricing. We believe there are several causes, but a big factor is the abundance of capital seeking yield. Preqin estimates that global real estate funds have $365 billion of dry powder to deploy. That capital continues to create a competitive transaction environment, placing upward pressure on pricing. The second reason keeping cap rates low is that real estate fundamentals are generally attractive. This creates two challenges for acquisitions. Some buyers are willing to pay more to win an asset because they believe in the future growth. They are effectively paying for future value today. This increases risk as expected growth may not materialize. The positive real estate fundamentals also potentially limit the assets marketed for sale, as existing owners may choose to hold rather than sell if they do not achieve their target pricing.

Our investment strategy has consistently targeted assets that provide attractive risk-adjusted return with downside protection and upside potential. While we believe the fundamentals in real estate are attractive, the current environment with historically low cap rates and rapidly rising interest rates, has increased risk. We continue to believe that defensive asset classes that are more resilient to economic disruptions, markets with favorable supply and demand fundamentals, and assets with in-place cash flows that can be grown to create value are compelling targets that offer a level of downside protection. Additionally, the ability to effectively execute on business plans, particularly the value-add component, is paramount in today’s environment.

Furthermore, to address the increased risk, we believe it is prudent to move down the risk spectrum to maintain further elements of downside protection. There is not one specific strategy. For example, risk can be reduced by employing less leverage, targeting stable investments, or seeking investments with higher acquisition cap rates. While higher cap rate investments generally carry more risk, which is why investors require a return premium, the tradeoff isn’t always one-for-one.

Over the past year, we have employed the strategies mentioned above. We continue to engage with new and existing sponsors to evaluate investment opportunities. While we see the upside potential in many opportunities, we are cognizant of the increased downside risks stemming from rising rates and the continued exuberance in asset pricing. We remained disciplined in our underwriting, focusing on asset fundamentals and downside protection. Many business plans will not meet our criteria and we will be patient for the right opportunities.