US Economic Outlook

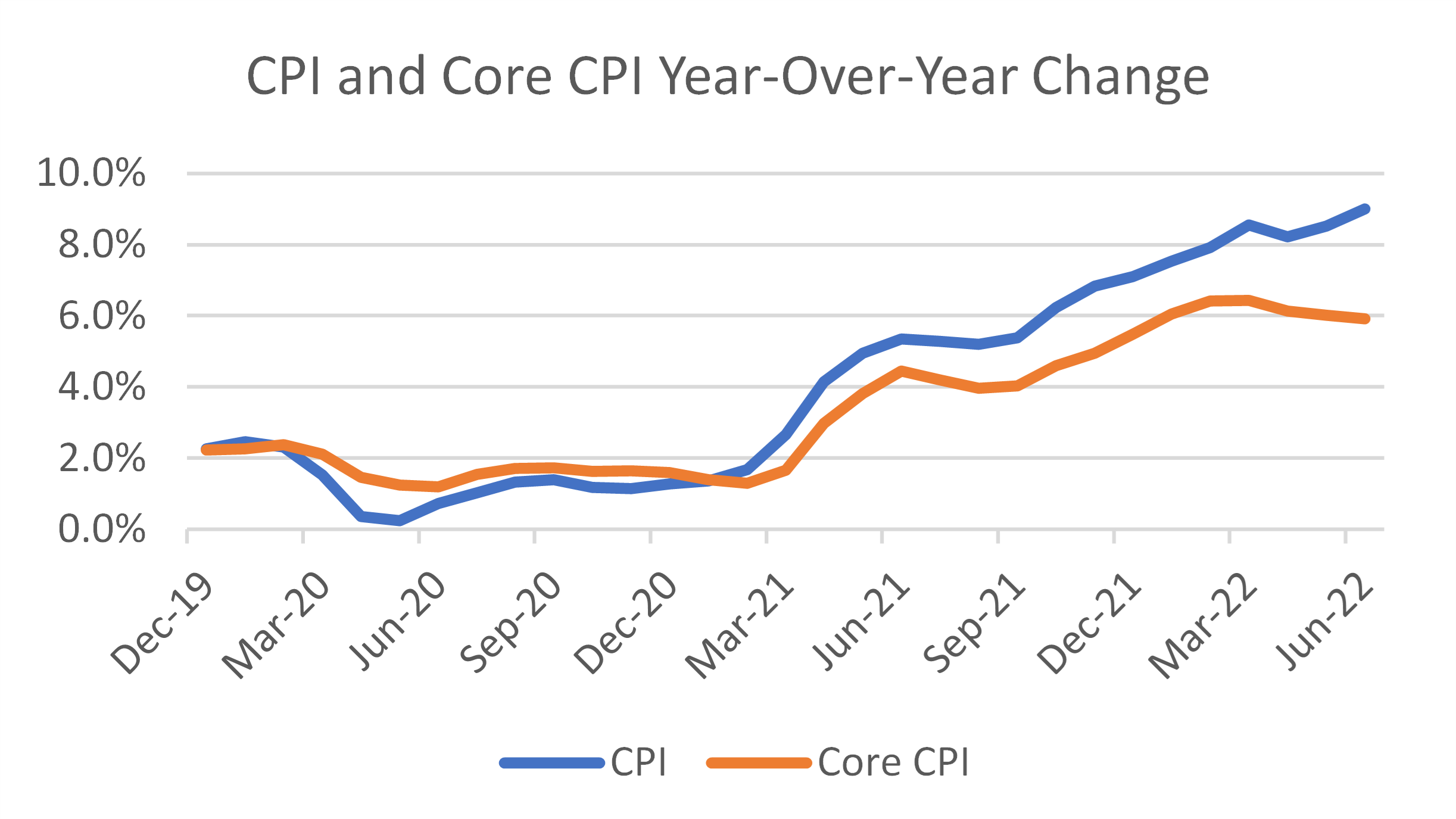

The pace of inflation has continued to rise from already elevated levels through the first half of 2022. The June Consumer Price Index (“CPI”) increased 9.1% year-over-year, the largest increase since the pandemic and in over 40 years. Energy was the biggest driver, accounting for nearly half of the increase. Excluding food and energy, Core CPI increased 5.9% year-over-year. Its growth has decelerated over the past several months and is down 60 basis points from the peak in March. While the decelerating Core CPI is encouraging, it provides little relief for consumers when inflation continues to outpace wage growth.

Despite sustained high inflation, the labor and consumer markets have remained strong. The June unemployment rate was unchanged at 3.6% for the fourth consecutive month. And although the country is close to reaching pre-pandemic employment levels, there is still a strong demand for workers with nearly two job openings for every job seeker. Consumer spending on discretionary items such as furniture, clothing, and dining out has remained robust, with second quarter spending rising 8.1% above the same period a year ago.

While the labor and consumer markets appear to be in good health, there are some headwinds on the horizon. Initial jobless claims have steadily risen throughout the second quarter, reflecting a rise in layoffs. The sustained consumer spending has come at the cost of savings. The personal savings rate has steadily declined since the end of the first quarter of 2021, and now sits below pre-pandemic levels. Additionally, business optimism and consumer confidence have both worsened. A decline in savings rate combined with weakening business optimism and consumer confidence could cause a pullback in investments and spending. However, while the savings rate is under pressure, there is still a significant amount of excess savings from the various pandemic relief programs, which could temper the impact of the declining savings rate.

With inflation remaining stubbornly high and the strength of the labor market, the Fed appears to now be prioritizing combating inflation over continued employment growth. Through the end of the second quarter, the Federal Reserve has increased the federal funds rate by 150 basis points. In July, the Fed added an additional 75 basis point rate hike, showing its willingness to continue moving aggressively to combat inflation. The hope is that demand will weaken as interest rates rise and the cost of borrowing becomes more expensive. The reduced demand should ease pressure on pricing, leading to lower inflation. However, while the Federal Reserve can seek to affect demand, there are factors contributing to the current inflation that remain outside the Fed’s control, such as the ongoing crisis in Ukraine, shutdowns in China, surging energy prices, and still snarled supply chains.

The Commercial Real Estate Landscape

While there has been increased economic and geopolitical uncertainty in 2022, a clearer picture is emerging regarding monetary policy. The Federal Reserve is now taking a more hawkish approach compared to expectations earlier this year. Interest rates have risen sharply over the last quarter and will likely continue to rise throughout the year as the Federal Reserve tries to rein in inflation. All things being equal, higher borrowing costs reduce investor returns. This impacts all companies, assets, and investments with debt.

As it relates to commercial real estate, although interest rates have risen significantly over the last quarter, transaction cap rates have yet to meaningfully adjust and remain at historical lows. Anecdotally, there appears to be a bid ask spread between buyers and sellers. Buyers have started to adjust business plans and pricing to consider rising interest rates. However, sellers are largely still targeting 2021 pricing and have thus far been reluctant to reduce pricing meaningfully unless they are under pressure to sell.

As a clearer picture of monetary policy emerges, it is possible that the bid ask spread will narrow. Recent data points to some price softening occurring in the second quarter of 2022. However, the data is preliminary, and the marginal softening comes off the back of significant pricing appreciation over the past two and a half years.

Overall, commercial real estate has experienced strong performance throughout the pandemic, and current fundamentals remain attractive. The supply and demand dynamics are favorable for many asset types, including multifamily, single-family rentals, and senior housing. There is a housing shortage in the country due to years of undersupply. Additionally, homeownership has become increasingly more difficult as inflation has eroded the personal savings rate, making it harder to save for a down payment, and rising interest rates have made mortgage payments more costly. Nationwide, the monthly mortgage payment increased by over 50% in May, compared to a year ago, due to rising interest rates and surging housing prices that remain at historical highs. This decrease in housing affordability means that homeownership for many will be delayed, increasing the demand for multifamily and single-family rental units.

The Alpha Investing Strategy

While rising rates will erode investor returns compared to a low-rate environment for all investments, we continue to have a positive outlook on the long-term fundamentals of commercial real estate. We believe there are opportunities to earn attractive risk-adjusted returns with targeted strategies. Our investment strategy remains focused on fundamentals-driven underwriting, sponsor selection, and downside protection. We have pivoted our investment targets to better provide downside protection in the current rising rate environment.

First, we are placing renewed emphasis on strong going-in yield relative to the borrowing cost. As interest rates are rising, we are targeting investments with higher going-in yield. Cap rates across all asset types and markets have compressed over the last few years. Certain high-growth markets and asset types have seen cap rates decline to around 3%. While low cap rates could be supported in a low-rate environment, the narrow to negative spread at today’s interest rates leaves little to no room to absorb further interest rate increases or downsides to the business plan. Higher cap rates can be found in different markets, such as secondary and tertiary markets, and asset types such as senior housing, or more stable investments. While we have little control over interest rates, we can determine the amount of leverage to use, impacting the total borrowing cost. Using less leverage can partially offset the impact of rising rates.

We are also evaluating investment opportunities that can be paired with long-term, fixed-rate financing to mitigate the impact of future rising rates. This type of financing has its pros and cons and is not suitable for every business plan. As its name suggests, long-term, fixed-rate financing offers certainty of borrowing costs and loan term. In a falling rate environment, fixed-rate financing can lock in unattractive, above market rate debt. Additionally, the loan duration offers less flexibility for earlier exits. Fixed-rate financing however, can be attractive during periods of rising interest rates as it locks in a lower rate and eliminates the exposure to future rate increases.

Finally, we continue to target investments with in-place cash flow and a clear path to improve yield. These investments offer value-add upside that is independent of market appreciation. We believe our investment strategy targets investments that can deliver strong risk-adjusted returns, while providing downside protection.

We continue to engage with new and existing sponsors to evaluate investment opportunities. Our target asset types are workforce multifamily, workforce single-family rentals, and senior housing. While we see the upside potential in many opportunities, we cannot ignore the increased downside risks in the current rising rate environment. We remain disciplined in our underwriting, focusing on asset fundamentals, value-add upside potential, and downside protection. Many business plans will not meet our criteria and we will be patient for the right opportunities.

We also continue to actively manage our existing portfolio to maximize value. In our value-add portfolio, we are closely monitoring operations and the value-add business plan execution. Additionally, stabilizing occupancy across our portfolio has become a primary focus. Stable occupancy delivers a strong revenue base and provides cushioning to absorb potential downsides such as rising costs or interest rates. We also continue to evaluate each investment’s business plan potential in conjunction with the transaction environment to determine the opportune time for exits.