US Economic Outlook

Since the start of the global pandemic, employment data has been a key to interpreting the scale of damage inflicted upon the US economy. Over 22 million jobs were shed in just the first two months of stay-at-home orders and physical distancing mandates. One year later, only 62% of the lost jobs have been regained, leaving 8.4 million jobs still to be recovered. The number of individuals filing new weekly unemployment claims remains elevated, averaging approximately 700,000 claims per week.

Permanent job losses nearly tripled during the pandemic and remains elevated at 3.4 million. Additionally, the number of individuals unemployed for 27 weeks and over has more than tripled from under 1.2 million at the onset of the pandemic to over 4.2 million individuals as of March 2021. As of March 2021, those unemployed six months or more now represent 43.4% of the total unemployed, up from 16.5% 12 months prior. As more job losses extend past six months, there is increasing risk that they convert to being permanent losses.

The key to our economic recovery continues to be our ability to control the COVID-19 outbreak. Throughout the pandemic, physical distancing measures, frequently in the form of mandated business closures, have been the main tool for controlling viral outbreaks across the country. In the first quarter of 2021, vaccines have emerged as a resource for protecting individuals and communities from the proliferation of the virus. Despite some setbacks, overall, the US has been successful in its vaccination efforts to date. As of late April, in just four months of vaccine distribution, nearly 30% of the US population has been fully vaccinated and over 40% of the population has received at least one dose of the vaccine.

While the US vaccine efforts are encouraging, at the global scale, there is a race of vaccinations against virus mutations and the challenge of reaching a vaccination level needed to achieve herd immunity. Globally, only approximately 2.5% of the world’s population is fully vaccinated. The lagging vaccination drive across the globe allows for the virus to continue to spread among the unvaccinated and for mutations to emerge, potentially complicating the ongoing vaccination efforts.

Since the start of the pandemic, Congress has passed over $5 trillion in spending, including over $850 billion in direct payments to individuals and families. The Federal Reserve has also flooded the market with liquidity. Despite the massive amounts of federal spending and liquidity, US real GDP decreased 3.5% in 2020 from 2019, driven primarily by decreases in consumption of services, namely transportation, recreation, and food and accommodations. A number of Americans saved a portion, or all, of their stimulus checks rather than spending it, as they remained uncertain about the economic outlook. There were also fewer consumption outlets for spending, since many services were not operating or operating at limited capacities.

As COVID-19 cases fell throughout the quarter and the vaccine rollout picked up steam, states loosened restrictions on physical distancing, which paved the way for business re-openings and travel. 1.6 million jobs were created in the first quarter of 2021, with leisure and hospitality representing 40% of those jobs. Several large employers announced plans to start bringing employees back in the office. In April, an average of 1.4 million people passed through TSA check points per day, an 80% increase from the average in the second half of 2020.

While the economy continues to recover, consumer prices rose in March, driven by a surge in gasoline prices. The Federal Reserve has announced there could be short-term inflation as the economy continues to open, particularly if there are supply bottlenecks, but believes that over the long run, inflation will remain near their 2% target. While employment in sectors hardest hit by the pandemic continue to recover, the Fed will maintain an accommodative monetary policy, keeping the target Fed funds rate near zero and continuing to increase its holdings of Treasury securities.

Commercial Real Estate

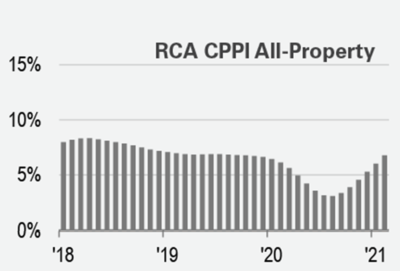

Overall deal volume in commercial real estate remains depressed in the first two months of 2021, with total volume across property types down over 50% from the same period last year. Asset pricing across all asset types has returned to near or above pre-pandemic levels, except for retail, which is still below 2019 pricing as big retail centers continue to struggle[1]. The recovered pricing and low transaction volume suggest that there are not a significant number of distressed sales.

Multifamily has been one of the strongest performing asset types over the last year, as it is need-based, and the federal government has provided various assistance measures for both tenants and owners during the pandemic. The national averages for multifamily asset pricing and rental rates have risen to all-time highs in the first quarter of 2021. However, not all asset classes and markets are performing equally. The migration out of high cost of living, densely populated markets such as New York, San Francisco, and Los Angeles accelerated during the pandemic, prompted by the ability to work from home and the limited availability of benefits typically associated with urban living. The main beneficiaries of the migration from primary markets are lower-cost secondary and suburban markets, many in the sunbelt states. Markets such as the Inland Empire, Sacramento, Phoenix, and Las Vegas all posted rent growth above 5% on a year-over-year basis in March, while the primary markets declined[2]. Asking rents in primary, urban-core markets are still well off their pre-pandemic levels, but the positive rent momentum across multifamily has lifted even the worst performing markets out of their troughs. As vaccinations in the US continue, some companies are starting to announce plans to bring employees back in the office, which may be the catalyst needed to jumpstart the primary, urban-core markets.

Overall, multifamily occupancy and collections have remained in the mid-90% throughout the first quarter of 2021[3]. While the fundamentals for multifamily remain strong, it is important to acknowledge that expanded unemployment benefits, rental assistance, individual stimulus checks, and eviction moratoriums, which are set to expire at the end of June, have supported strong multifamily performance during the pandemic.

Our other preferred asset class, senior housing, has struggled through the pandemic, as seniors are high-risk for adverse COVID-19 outcomes, and as the industry strives to regain public confidence after fatalities at several communities made headlines early in the pandemic. As a result, senior housing occupancy has been on a steady downward path since the onset of the pandemic, due in part to decreased demand. Despite these challenges, signs of recovery are beginning to emerge, as facilities and operators improve their ability to handle the pandemic. At the end of Q1 2021, 92% of senior housing residents and 63% of staff had been fully vaccinated, according to the National Investment Center for Seniors Housing & Care. The emphasis on vaccines, and improved protocols for handling cases effectively have set the stage for recovery in senior housing.

[1] Real Capital Analytics. February 2021

[2] YardiMatrix National Multifamily Report. March 2021

[3] The National Multifamily Housing Council (NMHC)’s Rent Payment Tracker’s survey of 11.6 million units of professionally managed apartment units across the country.

Alpha Investing Strategy

We are encouraged by the continued economic recovery and believe opportunities exist to achieve attractive risk adjusted returns through a targeted strategy. The recovery has not been uniform throughout markets and asset types, which is why we continue to focus on asset fundamentals and place an emphasis on downside protection in addition to upside potential.

Furthermore, there is a significant amount of capital targeting commercial real estate, which has driven cap rates down and asset pricing up. This places even more importance on the successful execution of business plans to drive value. Alpha Investing’s sponsor partners have extensive experience and established track records executing on their respective investment strategies. While the Fed has announced plans to keep an accommodative stance on monetary policy, including keeping the target Fed fund’s rate low until the labor market reaches “maximum employment”, our underwriting still expands cap rates at exit generally projected in years three to five.

We remain focused on our preferred asset classes, multifamily and senior housing, while also selectively considering opportunities in other asset classes. We believe the population growth of the sunbelt states, along with the relative affordability of those markets, provides an element of downside protection while offering the potential for attractive risk adjusted returns. Rental collections across the multifamily properties Alpha Investing’s network has invested in, which predominantly caters to renters by necessity, remains strong.

While there have not been a significant number of distressed sales during the pandemic, we believe these opportunities exist in senior housing, which has fragmented ownership with many smaller, less experienced operators. The sector has struggled during the pandemic, as senior housing is an operationally intensive business with low margins. As revenues decline and expenses increase, less experienced operators may find themselves with little to no cash flow. For an experienced operator, the distressed acquisition presents an opportunity to improve operations and cash flow to generate investor returns. Alpha Investing’s experienced senior housing sponsor implemented protocols early on to protect its communities, has fully vaccinated 100% of all residents and 75% of staff, and is actively looking for investment opportunities, including distressed situations.

In the first quarter of 2021, Alpha Investing closed on three multifamily investments, including two government-subsidized affordable housing projects and one value-add multifamily investment.

Recent Transactions

Multifamily Acquisition

Petersburg, Virginia

- A 53-unit, 1983-vintage, 100% occupied, affordable housing property in Petersburg, VA, located within the vibrant Richmond MSA

- This garden-style apartment community benefits from a project-based Section 8 housing contract with the Department of Housing and Urban Development, which covers all 53 units with an average subsidy of 86%. The property is 100% occupied with a 57-person waitlist

- The Sponsor owns a 148-unit property two blocks away and is under contract for another 66 units nearby, which will lead to operational efficiencies. The Property Manager is based in Richmond and manages over 5,900 units in Virginia, providing local market expertise with a strong track record for operating similar property types

- The acquisition is financed with attractive seven-year, floating rate, agency financing at 75% loan-to-value with two years of interest only and an initial rate below 3%. Debt service coverage ratio during the interest only period is projected to exceed 3.4x and average 2.0x when the loan begins amortizing

Multifamily Acquisition

Chicago, Illinois

- Off-market acquisition of an affordable housing portfolio at a 7.9% projected Year 1 acquisition cap rate

- Portfolio is 78.8% leased, and 64% of in-place rental revenue is paid for through the Chicago Housing Authority’s (“CHA”) Housing Choice Voucher Program, which pays a portion of eligible families’ rent each month directly to the property owner

- The properties were significantly renovated prior to acquisition, with the seller infusing $25,000 – $45,000 per unit to update interiors and exteriors

- Experienced sponsor and local property manager who currently manages over 3,000 affordable housing units in the South Side of Chicago and has a strong relationship with the CHA

Multifamily Acquisition

Fort Worth, Texas

- 356-unit, garden-style apartment community in Fort Worth, TX, on the border of East Fort Worth and the entertainment district of North Arlington, one of the strongest submarkets in Dallas-Fort Worth (“DFW”)

- The property’s ideal location provides residents with convenient access to employment, entertainment, and retail. DFW is the fourth largest MSA in the US with a population of over 7.5 million. The population is expected to grow by 2.6 million by 2030, driven by strong job creation, as DFW has consistently led the nation in total jobs added over the last few years

- The seller invested $2.6 million in capital expenditures on deferred maintenance, exterior updates and unit renovations, proving demand for renovated product. The Sponsor will execute a strategic renovation plan to rebrand the property and improve the renovation scope to capture additional upside in a strong submarket