US Economic Outlook

US GDP grew by 2.5% in 2023, driven by strong consumer spending and a strong labor market. The US added 2.7 million jobs and unemployment remained below 4%, ending the year at 3.7%. At the same time, inflation has continued to moderate. Core inflation, as measured by the Personal Consumption Expenditures index, has run at a 2.0% annualized rate over the past six months, right in line with the Fed’s target.

Consumption grew at a robust pace of 2.8% in the fourth quarter of 2023 and continues to drive the economic expansion, despite high interest rates. Cooling inflation and a tight labor market have led to real wage growth throughout most of the year. The rise in earnings power, combined with tempering inflation and the anticipation of lower interest rates ahead, has bolstered consumer sentiment. The Conference Board Consumer Confidence Index reached a two-year high in January after increasing for three consecutive months.

2023 ended with stronger than predicted economic growth, low unemployment, and moderating inflation. Although consumers and businesses feel better about the economy compared to the start of last year, there remain risks to economic growth and inflation.

While consumer sentiment is improving, consumer health is declining. Wages have grown, but overall income growth, which adds interest income and government payments to wages, has slowed. Furthermore, consumer spending has outpaced income growth. Consumers have accumulated over $17 trillion of debt, representing nearly 10% of household disposable income. The reliance on debt and savings to cover the difference between spending and income growth does not appear to be sustainable.

Geopolitical tensions in Europe and the Middle East, and attacks in the Red Sea have caused disruptions to commodity prices and supply chains. Supply chain disturbances, combined with robust consumer demand driven by strong employment, pose inflationary pressure risks.

The Fed has held its benchmark rate unchanged at 5.25-5.5% since last July and softened its language around future rate hikes. In December, the Fed announced its current expectations for three 25 basis point rate cuts in 2024. It is important to note that actual monetary policy can differ from the Feds published projections. Most recently, the Fed repeated revised projections for the quantity and magnitude of rate hikes in the current cycle. The current sentiment is that interest rates have reached the terminal rate for this rate tightening cycle. However, the Fed remains focused on inflation risks, which will ultimately dictate monetary policy.

The Commercial Real Estate Landscape

The commercial real estate market continued to cool in 2023 with total transaction volume declining by 53% on a year-over-year basis while pricing was down 22% from the high set in March 2022. Both indicators saw the pace of decrease moderate over the latter part of 2023, but declining asset values and the continuation of bid-ask spreads between buyers and sellers constrain overall activity. Multifamily transaction volume in 2023 declined more than the average for all commercial real estate asset types, declining 61% year-over-year.

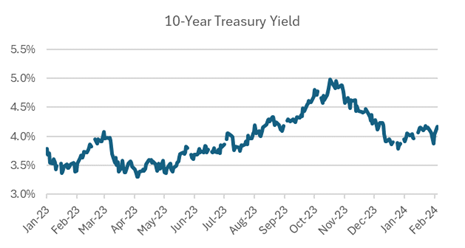

Interest rates will remain at the forefront of commercial real estate discussions in 2024. Current indications are that we are at the peak of this monetary tightening cycle. The ten-year Treasury has declined approximately 100 basis points, based on the anticipation of rate cuts this year, and has hovered around 4.0%. Nevertheless, interest rates in 2024 will likely remain elevated compared to recent years, requiring buyers and sellers to continue recalibrating their views on asset valuations.

There is approximately $1.2 trillion of outstanding commercial and multifamily mortgages maturing in 2024 and 2025[1]. Many owners will be facing a capital markets environment with higher interest rates than previously anticipated. Refinance proceeds may also be limited by minimum debt service coverage requirements and maximum leverage constraints. Additional capital will be needed to fund the gap between the maturing loan balance and refinance proceeds. Owners who cannot secure a new loan or otherwise repay the existing loan will be forced to sell.

Lenders have been amenable to working with borrowers on loan modifications or workouts where they see the medium- to longer-term value of the real estate and the borrower is committed to the asset. However, the volume of near-term debt maturities may drive more transaction activity in 2024.

In addition to the higher cost of debt, operating costs have increased substantially over the last few years, namely in payroll, insurance, and utilities. While the pace of growth is moderating, operating expenses remain elevated. In the face of these rising costs, the need to improve revenue and NOI remains paramount.

[1] Mortgage Bankers Association

The Alpha Investing Strategy

Alpha Investing significantly slowed our acquisition pace in 2023 as we believed pricing had not adjusted enough to offset the rise in interest rates. Considering the current interest rate environment, our focus remains on acquisitions with high in-place yield and positive leverage, where the going-in yield is higher than the cost of debt. Furthermore, we look for fundamentally sound real estate with outsized upside potential relative to the downside risk. These opportunities remain limited, as owners who do not need to sell are holding onto their assets and waiting for an improved capital markets environment.

We continue to believe in the medium- to long-term fundamentals of investing in commercial real estate. We believe our targeted multifamily tax abatement strategy is compelling because it provides above-market yield. These investments are financed with long-term, fixed-rate debt, so the cost of debt is known and fixed at acquisition. We have not seen actionable opportunities in this strategy since bond yields reached a 16-year high in October 2023 and eliminated the incremental spread between tax abatement multifamily going-in yields and financing costs. So far through January 2024, bond yields are down nearly 100 basis points from October highs. We will continue to pursue this strategy if the appropriate spread between going-in yield and financing costs exists.

We continue to seek acquisition opportunities in senior housing, which has been the strongest performing asset sector within Alpha’s portfolio since the current rate tightening cycle began. Our recent acquisitions had low double-digit going-in yields with opportunities to further improve yield with an experienced operator. Rising operating costs and a prolonged elevated interest rate environment have created challenges for operators. We continue to evaluate opportunities to acquire fundamentally sound senior housing properties with upside potential at attractive yields.

On our existing portfolio, we remain focused on securing holding power to better position assets to maximize value. We are also focused on stabilizing and improving operations across our portfolio. We are seeing rising occupancy and decreasing delinquency and hope to further improve on the progress made in 2023. We are also continuing value-add business plans to improve revenue further.