In this edition of Alpha Insights, we would like to invite a deeper discussion on the broader economic and commercial real estate landscape through our updated CRE whitepaper.

The Current Commercial Real Estate Landscape

Business and consumer spending have returned to pre-pandemic levels despite some shifts in consumer spending habits and a higher cost environment for businesses. The labor market, however, has struggled to replace pandemic-era job losses, with soft job creation at the end of the quarter. At the same time, job openings and the quits rate have reached record levels, indicating hiring challenges.

As higher inflation looms, it could hinder the recovery and add complexity to the Federal Reserve’s goal of promoting maximum employment and price stability. While the Federal Reserve has so far maintained its view that the high inflation we are experiencing is transitory, it has acknowledged that inflation will likely continue to remain elevated in the coming months.

Some sectors of commercial real estate have demonstrated impressive resilience in the face of the pandemic-driven downturn. Multifamily, single-family rentals, and industrial assets have experienced strong performance through the third quarter of 2021. Furthermore, in-place fundamentals continue to present favorable outlooks for these sectors.

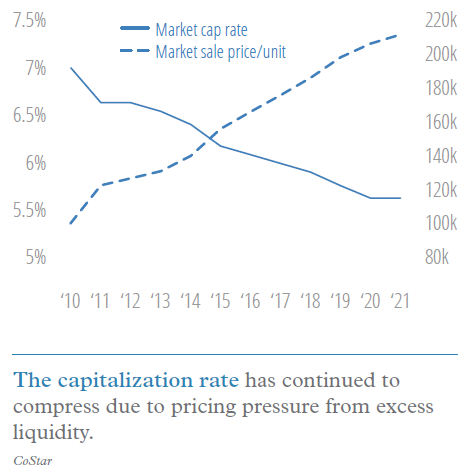

We continue to believe there are opportunities to earn attractive risk-adjusted returns through commercial real estate. However, we are cognizant that the recovery has been uneven and pricing pressure due to excess liquidity has continued to compress cap rates.

Our investment strategy remains focused on our sponsor-first investing philosophy and targeting investments with clear downside protection that offer value-add upside to deliver strong risk-adjusted returns, independent of market appreciation. Our target asset types are workforce multifamily, senior housing and workforce single-family rentals. We also continue to actively manage our existing portfolio to maximize value and realize returns where available through refinancings and early sales.