Economic Overview

The COVID-19 recession officially ended in April 2020, lasting only two months, according to the National Bureau of Economic Research. Since then, the US economy has grown for four consecutive quarters, through the second quarter of 2021, as businesses and individuals adapted to operating in a pandemic environment and pharmaceutical companies raced to develop vaccines at a breakneck pace. Accelerated vaccination efforts combined with state and local COVID-19 restrictions led to declining reported COVID cases in the US in the first half of the year.

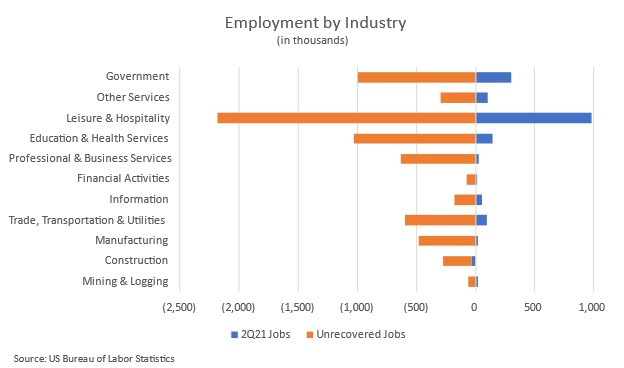

As cases declined, much of the country has relaxed COVID-19 restrictions, including physical distancing, capacity limits on businesses, and mask mandates. Reopening has resulted in a notable increase in monthly job gains, with 1.7 million jobs added in the second quarter of 2021, led by leisure and hospitality. While the continued job gains are positive, the economic impact and recovery have been uneven, and there remains a shortfall of 6.8 million jobs compared to the pre-pandemic peak observed in February 2020.

For much of the US, this summer has shown glimmers of a return to pre-pandemic life. Consumer spending on services has steadily increased as businesses returned to full or near full capacity, and the number of passengers passing through TSA check points per day is back to 80% of pre-COVID levels. However, the number of daily reported COVID cases in the US is rising again after months of decline due to more transmissible variants of the virus and the easing of COVID restrictions. While we have made progress towards recovery, continued COVID-19 outbreaks, domestically and globally, cloud the outlook.

Over the course of the pandemic, the Federal government has passed nearly $5.8 trillion in relief measures, and eviction moratoriums and other protections aimed at assisting the most vulnerable. Additionally, the Federal Reserve (the “Fed”) has supported the economy by lowering interest rates, increasing purchases of Treasury securities, and introducing several facilities to support credit markets and businesses. The Federal assistance has propped up the economy during unprecedented times, but it has also flooded the market with liquidity and capital, potentially leading to inflation risk.

Household savings across the US has increased by $2 trillion since the beginning of the pandemic[1], driven by stimulus checks and expanded unemployment benefits, and consumers’ inability or reluctance to spend amid COVID restrictions and heightened uncertainty. In the second quarter, the Consumer Price Index (“CPI”) rose faster than the Fed’s long-term inflation target of 2%. The resurgence in economic activity, coupled with temporary supply disruptions, have pushed up costs of goods and services steadily over the first half of 2021. Additionally, median price of existing homes sales, which is excluded from CPI, reached record highs in June, increasing 23% year-over-year, driven by strong demand against low inventory, and low interest rates.

The Fed considers the current elevated inflation to be temporary and remains accommodative in supporting the economy to achieve maximum employment. Time will tell if the current inflationary pressures are indeed only transitory or will be longer lasting.

[1] Federal Reserve Bank of Kansas City. April 29, 2021

Commercial Real Estate

Commercial real estate has mostly fared well during the pandemic, although some asset types have performed better than others. Capital has been targeting assets that performed well during COVID-19, especially the multifamily sector, which continues to make up an increasing share of total capital deployed into commercial real estate.

Multifamily has historically performed well during recessionary periods due to strong underlying fundamentals, but the assistance extended by the Federal government has further boosted the sector’s performance. The National Multifamily Housing Council has reported that rent collections have remained above 93% throughout the pandemic, despite the hardship experienced by many renters. Performance has varied from market to market. Urban core markets have seen a fall in demand as many workers had options to work remotely, while markets with robust in-migration posted strong rent growth throughout the pandemic.

Most metros posted strong rent growth during the second quarter. A Yardi Matrix multifamily report of the top 30 markets found rents increased 6.3% year-over-year in June 2021. Overall, rents grew $12 in May and $23 in June, each representing the largest one-month increases in the history of their reporting. While all markets saw month-over-month rent growth in June, which is a sign of positive momentum, rents in the gateway markets of New York, San Francisco, and San Jose are still down compared to a year prior and pre-pandemic peaks. Secondary markets, including Phoenix, the Inland Empire, and Las Vegas continue to lead the nation in rent growth, driven by strong in-migration.

The recent surge in home prices may further bolster already strong multifamily fundamentals. In June, the median price of existing homes in the US rose by 23% to $363,300, from $294,400 in June 2020, driven by strong demand against a low supply of homes for-sale, mortgage rates that remain near historic lows, and growing interest from institutional capital. Rising home prices and the low inventory of houses for sale will likely keep more people in the renter pool for a longer period, as housing affordability and availability become further squeezed.

Multifamily performance has benefited from the assistance extended by the Federal Government. Many of those provisions are set to expire in the coming months, including the federal eviction moratorium and expanded unemployment benefits. Additionally, we have yet to see how a full reopening of the nationwide economy will affect people’s lifestyle and living preferences. It is possible these factors taper rent and occupancy growth, but overall, multifamily performance is expected to remain solid.

Alpha Investing Strategy

Alpha Investing continues to believe that there are opportunities in the market to earn attractive risk-adjusted returns through commercial real estate. Certain sectors within commercial real estate, including multifamily, have had strong performance throughout the pandemic. As the economy continues to recover, job gains and increased spending on services will continue to support commercial real estate fundamentals.

In 2021, we have seen capital continuing to target strong-performing assets, which has driven up pricing and caused cap rates to compress. While growing optimism can be felt across the US, virus variants and rising cases threaten to put a damper on recovery efforts. We remain committed to our sponsor-first investing philosophy, targeting workforce multifamily, senior housing and single-family rentals. We perform thorough diligence on all prospective investments to identify potential risks, and target opportunities that exhibit outsized upside potential.

To guard against downside scenarios, Alpha Investing continues to focus on geographies with sustained growth that performed well throughout the pandemic. Additionally, we continue to target acquisitions predicated on value creation rather than those that rely simply on market growth or cap rate compression. Our underwriting generally assumes cap rate expansion at exit.

We continue to actively manage our existing portfolio of investments to maximize value. We are evaluating debt refinancings at several investments to take advantage of low interest rates and asset level appreciation to return a portion of investor capital. We are also exploring early sales to capitalize on the low cap rate environment for several investments where significant value creation has already been achieved.