While rental housing is typically thought of as apartments, single-family rental (SFR) properties in fact made up 53% of the total rental market in 2019. However, ownership within this asset class is extraordinarily fragmented, with the overwhelming majority of SFR properties being owned and operated by individuals or very small investors. Prior to the COVID-19 pandemic, large-scale institutional investors only owned approximately 1% of SFR properties.

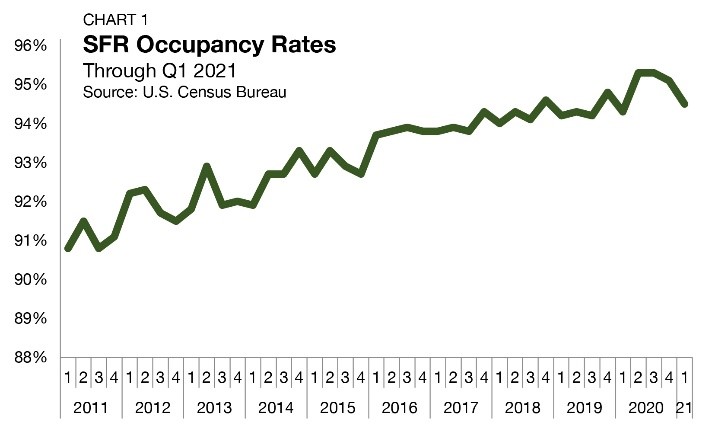

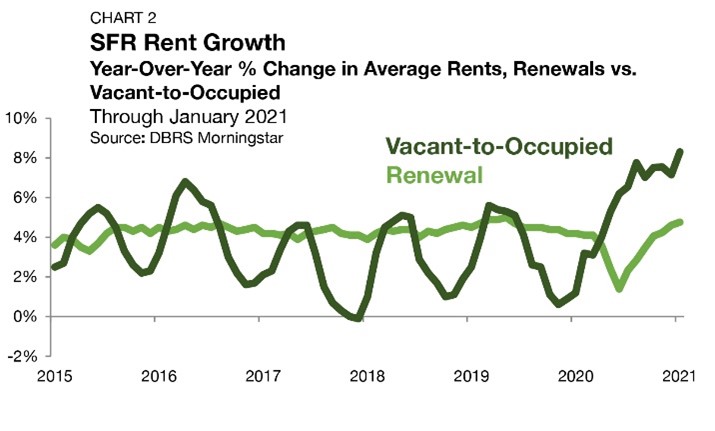

The SFR asset class remained resilient throughout the COVID-19 pandemic. Like multifamily, SFR rent collections remained strong, supported by stimulus payments and expanded unemployment benefits through the legislative action of the federal government. According to Arbor Realty, occupancy within SFR reached a historic high of 95.3% during the pandemic and averaged 94.5% as of Q1 2021. Simultaneously, rent growth within the asset class accelerated to a new historic high of 8.3% in Q1 2021, fueled by a shortage of supply.

Source: Arbor Q1 2021 Single-Family Rental Investment Trends Report

Source: Arbor Q1 2021 Single-Family Rental Investment Trends Report

As a result of the strong performance of the SFR asset class through COVID-19, there has been a significant increase in interest from institutional capital in the past year. A May 2021 report by Redfin indicated that institutional investors acquired a record $77 billion worth of homes in the preceding six months. Nonetheless, Walker & Dunlop estimates the SFR market to be valued around $3.4 trillion. As such, ownership within the asset class will remain extraordinarily fragmented for the foreseeable future, despite increased interest from institutional investors.

Alpha Investing began evaluating the SFR asset class as an investment opportunity during the fall of 2020. After careful consideration, we selected an operating partner and began acquiring properties in the spring of 2021. Our partner is a vertically integrated private real estate investment firm that focuses on acquiring single family residential rental homes in select markets in the United States. The key principals collectively have over 30 years of single family housing experience and have acquired over 10,000 SFR properties. After promising initial results, we will now be making SFR investment opportunities available to our entire investor network.

As within multifamily, we are remaining focused on workforce housing within the SFR asset class by targeting assets that we expect to have a weighted average cost basis in the $100K range. Our acquisitions will typically require $10K – $20K of upfront capital improvements and repairs. Such improvements are likely to include new flooring, painting, upgraded plumbing and light fixtures, repairs and/or replacements to roofing, HVAC units, water heaters, etc. Performing a more durable renovation upfront is expected to yield less exposure to unexpected repairs and maintenance expenses in subsequent years. After improvements, we expect our assets to generate gross rental yields in the low to mid teens, yielding high single-digit cap rates. In addition, we will target stable secondary and tertiary markets that exhibit fundamentals that support our investment strategy. Thus far, we have identified two initial markets, and are currently evaluating several others. Once again, Alpha Investing has partnered with an experienced SFR owner/operator to execute this strategy.

By focusing on assets with a weighted average cost basis in the $100K range, Alpha Investing will remain well below the radar of larger institutional investors that are forced to acquire much more expensive homes due to the quantity of capital they must deploy. Simultaneously, we expect to build a portfolio of 1,000+ homes across multiple markets over the next few years, which will allow us to achieve far greater operational efficiencies than a typical individual owner or smaller investor.