Economic Outlook

US GDP grew by 5.7% in 2021[1], a remarkable achievement considering the ongoing global pandemic. However, the mutating coronavirus continues to be the wildcard impacting business and consumer activity and decisions.

The fourth quarter started out with strong jobs growth in October, but hiring slowed in November and December, despite job openings remaining at historic highs with over 10.5 million openings. Furthermore, even with lackluster job growth to finish the year and a shortage of 3.6 million jobs compared to pre-pandemic levels, the headline unemployment rate has continued to fall. The US unemployment rate declined to 3.9% in December, representing the first time since the onset of the pandemic that the unemployment rate has fallen back below 4%. The quits rate at year end also remained at record highs. All of this suggests that the issue is not a lack of jobs available, but rather a lack of workers, which if prolonged, could hinder business growth.

Wage growth surged 4.7% for the year, beating expectations and further reflecting the competition for available workers. Wage gains were highest in the traditionally lower wage industries of accommodation and food services, which are also the industries that had the highest quits rates. While the labor force participation rate is still below pre-pandemic levels, the participation rate increased to 61.9% at year end, the highest rate since the start of the pandemic, indicating that wage increases may be one of the factors enticing individuals back into the workforce.

The strong wage gains, however, did not translate into real wage growth. The Consumer Price Index (“CPI”), a common measure of inflation, rose 7% in 2021, which is the highest annual increase since 1982. 2021’s inflation spike is due, in part, to base effects from 2020 pandemic lows, and to increased recovery demand, against a backdrop of pandemic-induced supply constraints, labor shortages and surging energy costs. Food, energy and shelter, which make up over 50% of CPI, posted the largest annual gains since 2008. In the second half of 2021, consumer spending on nondurable goods, including food and energy, increased, likely due in part to inflation, while spending on durable goods fluctuated. While it’s too soon to definitively conclude that consumers are offset rising food and energy costs by reducing spending elsewhere, if inflation continues to outpace wage gains, a larger portion of consumer income will be spent on essential items, which would lead to reduced spending on discretionary items or savings.

Elevated levels of inflation, combined with an improving labor market, has led the Federal Reserve (the “Fed”) to move with more urgency to address inflation. In December, the Fed announced plans to accelerate the pace of tapering, which would end its asset purchase program several months ahead of its previous timetable. While the Fed kept the federal funds rate unchanged, remaining near zero, it has now signaled it will start increasing rates soon, potentially as early as March.

[1] Advanced estimate.

Commercial Real Estate

Overall, commercial real estate had strong performance in 2021. Multifamily and industrial, in particular, saw robust rent gains. Nationwide, multifamily rents grew 13.5%, 8 percentage points higher than the previous peak in 2015. Furthermore, strong rent growth was seen across all major markets, with 26 of the top 30 markets seeing double digit rent growth. Single family rentals (“SFR”) were also in high demand, with asking rents rising 13.8% in 2021[2]. Although part of the outsized gain in 2021 is due to low base effects, coming off a flat 2020, demand for housing, multifamily and SFR, remains strong.

The pandemic shifted living arrangements and migration patterns and continues to add uncertainty for businesses and consumers. Work from home provided flexibility as to where workers can live and shifted priorities to include more living space. As a result, 2020 saw a migration out of expensive primary markets to nearby, lower-cost-of-living, secondary markets at the onset of the pandemic. While many companies continue to postpone return to office plans due to the resurgence of COVID-19 cases, demand has started to return to primary markets.

Although multifamily and SFR are still poised for strong performance due to strong demand, there are some headwinds on the horizon. Wage gains have not kept up with rent increases, which makes housing relatively more expensive, and may temper future rent gains. At the same time, operating expenses and renovation costs are generally rising. The interest rate hikes expected later this year will also increase the cost of borrowing, which would reduce investor yields.

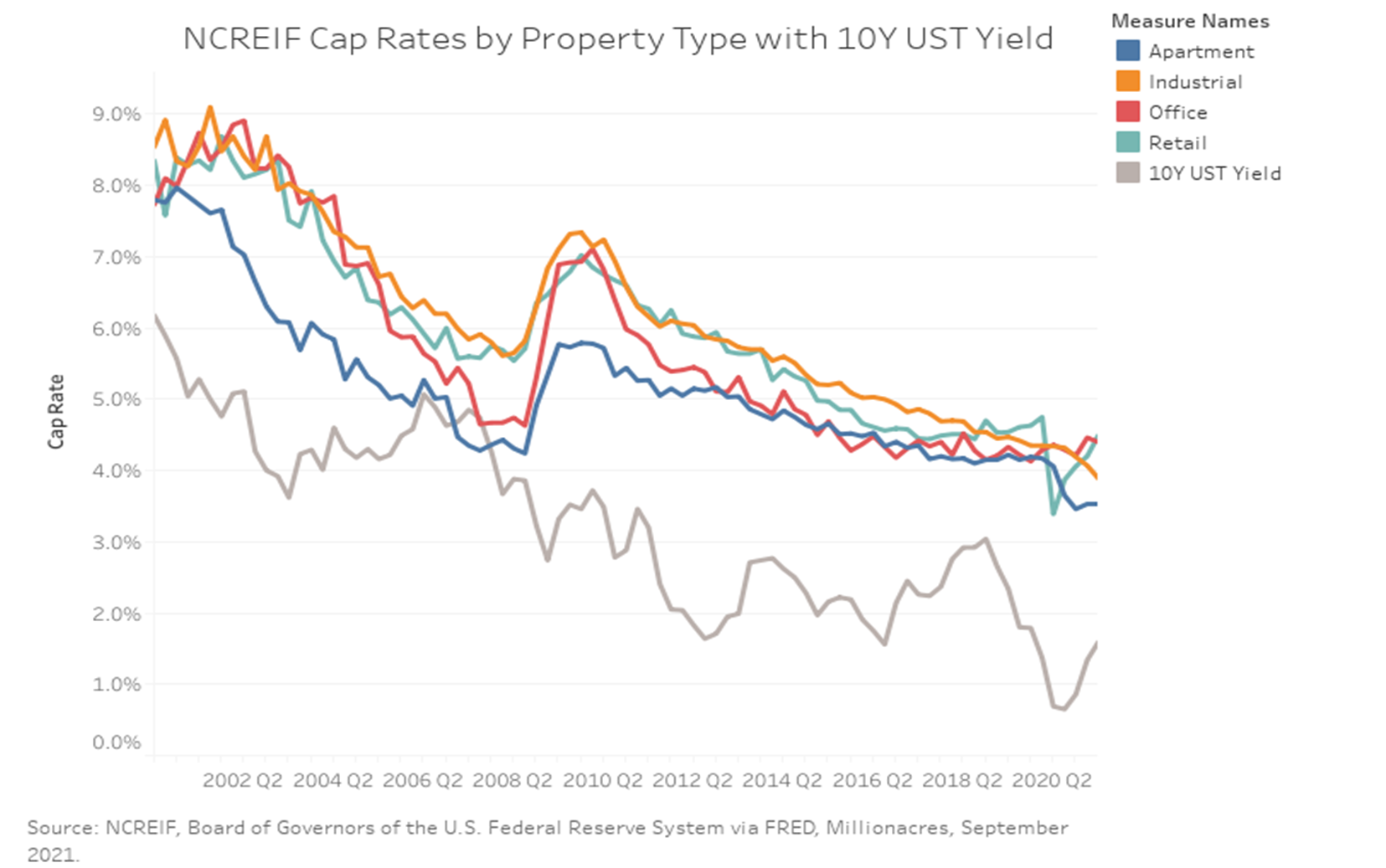

Rising interest rates also present a unique challenge in the current, low cap rate environment. Historically, rising interest rates have generally led to expanding cap rates, although there are some periods that buck this trend, including the years preceding the pandemic-induced recession. In 2018, when the Fed raised rates four times after nearly a decade of near zero interest rates following the Great Recession, we observed with some perplexity as cap rates continued to compress. Some economists believe the same thing will happen today, due to the sheer amount of capital available.

[2] Yardi Matrix. December 2021 National Multifamily Report.

Alpha Investing Strategy

While we do not have a crystal ball to tell in what direction cap rates will or will not move, we continue to have a positive outlook on fundamentals-driven commercial real estate and believe there are opportunities to earn attractive risk-adjusted returns.

Our investment strategy remains focused on our sponsor-first investing philosophy and targeting investments with clear downside protection and strong upside potential, relative to risk. This is important in the current environment of low acquisition cap rates and anticipated interest rate increases. Elements that offer downside protection include defensive asset classes that are more resilient to disruptions in economic activity, markets with favorable supply and demand fundamentals, and in place cash flows that allow for the absorption of some downward pressures.

Additionally, we are targeting investments that offer value-add upside that can deliver strong risk-adjusted returns, independent of market appreciation. Since the 2008 Great Recession, cap rates have generally trended lower as the economy recovered and grew, causing asset prices to rise, irrespective of whether value creation occurred. Our underwriting generally includes cap rate expansion, so the pricing premium is coming from value creation versus market appreciation.

Our target asset types are workforce multifamily, senior housing and workforce single-family rentals. We believe workforce multifamily in markets with favorable supply and demand fundamentals will continue to experience strong performance. While the pandemic disproportionately impacted senior housing, we continue to believe in the long-term fundamentals and will seek opportunities to acquire underperforming assets with our experienced senior housing operator. We added single-family rentals to our target assets this year, focusing on workforce housing, as we believe the sector’s fundamentals are like those found in workforce multifamily. Additionally, we believe there is further upside potential through scale due to the fragmented ownership in the space.

We continue to actively manage our existing portfolio to maximize value. While cap rate compression has led to challenges on the acquisition front, we have sought and continue to seek opportunities to capitalize on the market appreciation for our current portfolio where significant value creation has already been achieved, through refinancings and early sales.