US Economic Outlook

The Fed has a dual mandate to promote price stability and maximum employment. However, it has made clear it is willing to temporarily trade off increased unemployment to return closer to its 2% inflation target. Although the Fed believes the labor market is too tight, recent data suggests that the supply/demand equilibrium is being restored. The number of job openings fell below 10 million for the first time since May 2021, wage growth has continued to come down from its recent highs, job growth has expanded at a slower pace, and the labor participation rate has increased slightly. These metrics continuing to move in the Fed’s desired direction would aid in cooling the economy, but progress has been sluggish, and any one month’s improvement can revert in subsequent periods.

In addition to the labor market trending toward balance, inflation readings have shown improvements since peaking in 2022. March CPI inflation data came in at 5.0%, the lowest since May 2021. Over recent months, the leading contributor to CPI figures has been shelter costs, which we know to be lagging since rent growth has been slowing as of late Q2 2022. Additionally, the Fed’s preferred measure of inflation, the Personal Consumption Expenditure Index (PCE), continues its trend of decelerating.

Although inflation has shown signs of moderating relative to its 2022 peaks, it remains substantially higher than the Fed’s long-term target of 2%. However, early 2023 has brought forth a new set of challenges for the Fed, as the banking industry was recently rocked when SVB and Signature Bank failed over a span of a few days, followed closely by Credit Suisse, forcing an acquisition by rival UBS. Capital markets were spooked, leading officials to swiftly inject liquidity and promise to backstop US customer deposits to provide the needed stability. As a consequence of these failures, the Fed anticipates that banks will have to tighten lending, which may substitute for further rate hikes. To what extent they will tighten and how that will impact the economy remains to be seen.

Although the Fed raised interest rates by a further 25bps at the most recent meeting, Fed Chairman Jerome Powell indicated that the central bank no longer believes that ongoing rate increases will be appropriate to quell inflation, a notable change in messaging. The terminal rate remains unchanged from December’s projection of 5.1%, which represents approximately 25bps of expansion from the current rate of 4.75-5.0%. Despite the change in rhetoric regarding interest rates, the Fed’s actions in 2022 make clear their dedication to defeating inflation, which remains stubbornly high. Should prices continue to rise, further rate increases may be back on the table.

Cracks have also continued to show in the health of the consumer. With the exception of January, consumer spending adjusted for inflation has slowed over recent months, while the most recent data shows that consumers are beginning to make substitutionary purchases. These consumption patterns come at the same time that wages are cooling, the savings rate remains below the historic average, and consumer credit is at historically high levels. All of these signs point to an increasingly weakened consumer.

Given the combination of stubbornly high inflation, a weakened consumer, and the recent turmoil experienced in the banking industry, it is clear that the Fed faces a precarious situation as it attempts to raise interest rates high enough to cool inflation and the labor market without overtightening. The most recent reports indicate that rising interest rates are beginning to take effect in cooling the economy, but tackling persistent inflation remains the Fed’s priority, as they are willing to sacrifice some short-term pain in the labor market to get inflation under control. As such, the Fed will continue to monitor inflation readings and may adjust monetary policy when appropriate.

The Commercial Real Estate Landscape

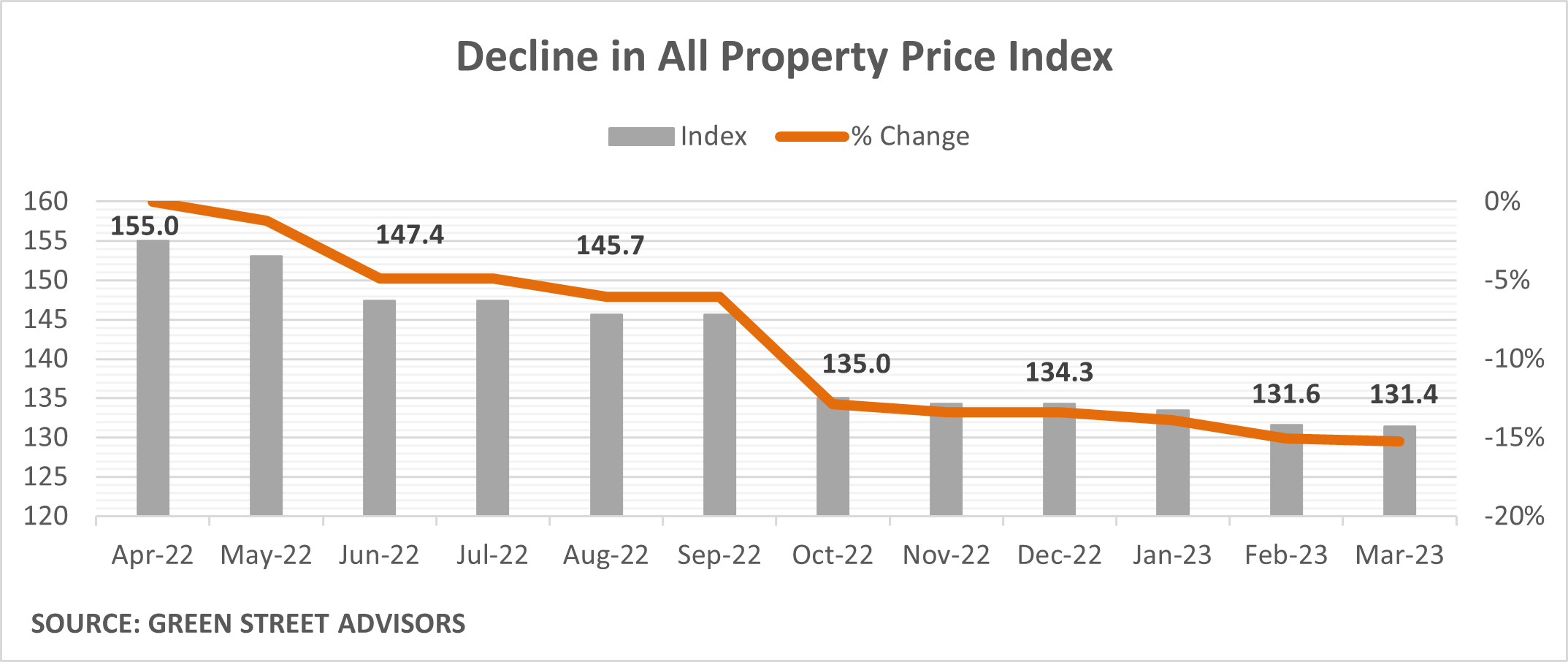

The commercial real estate market is continuing the process of repricing. The specter of higher interest rates with no clear timeline of pricing relief has settled over the industry. Since prices peaked in 2022, the all property index is now down 15% with transaction volume in Q1 down even further. The chart below depicts the downward trend in commercial property prices. (The benchmark value of 100 was set in August 2007.) Additionally, it is unclear how much the recent bank failures will tighten credit availability for new transactions and development since small and mid-sized banks hold nearly 70% of all commercial real estate loans.

This repricing and potential lack of available credit are rolling through the industry at the same time there is a historic wave of debt that will be maturing over the next several years. Owners of properties will be refinancing in a much higher interest rate environment than was originally expected. In many cases, they will need equity injections to continue to hold the asset. However, there remains ample dry powder on the sideline that can be put to work. In instances where a deal no longer makes sense, owners and lenders will need to collaborate to create workouts. Both equity injections and loan workouts will be dependent upon the property type and capital structure. Although we anticipate workouts being achieved, we expect to see some distress across the commercial real estate market over the coming years.

The near-term economic uncertainty has continued to make operating assets more difficult. Business and consumer confidence have hovered at near recession levels for an extended period of time. Small businesses indicated a sharp drop in the number that had added more employees over the past six months. Consumer confidence fell for the first time in four months, and it continues to languish around levels commonly associated with a recession. Ultimately, such low consumer confidence will delay business expansion and hiring, resulting in less need for commercial real estate space, fewer jobs added, and the potential for layoffs. In addition, as consumers continue to be less optimistic about their economic prospects, they will delay making major purchases such as a car or house.

The national real estate market continues to feel the impact of economic uncertainty. Demand has been pulled back as businesses and consumers alike hunker down and wait for the economic winds to change. Declining demand has resulted in higher vacancy, increased delinquency, and cooling rent growth. Operators are hard pressed to retain and attract high quality tenants, maintain occupancy, and grow revenue. Although inflation appears to be moderating, the operating environment still faces increased costs as expenses like insurance, utilities, and labor remain high. The near-term outlook is challenging, however, Alpha Investing remains steadfast in our belief in the attractive long-term fundamentals within our target asset classes.

The Alpha Investing Strategy

Alpha Investing continues to believe in the fundamentals of investing in select asset classes within commercial real estate. However, we are cognizant that there are numerous near-term challenges. Economic uncertainty has resulted in weaker demand and rising delinquencies, slowing revenue growth. At the same time, operating expenses and borrowing costs have risen, which has led to reduced margins and cash flow.

Despite the current uncertainty, Alpha Investing believes there are strategies to navigate this environment. We have continued to focus on pursuing investments that have durable, in-place cash flow where the going-in yield is higher than the cost of debt. On the financing side, we are generally using lower leverage compared to 2021 and 2022, and our preference is to acquire assets using fixed-rate financing. Where fixed-rate financing is unavailable or not optimal at acquisition, we will seek to purchase rate caps for floating rate debt to lock in the maximum cost of borrowing at acquisition.

On the acquisition front, we are starting to see sellers adjust pricing expectations and expect this trend to continue. Some sellers are selling out of necessity due to external factors, such as upcoming debt maturities, length of hold, or an inability to effectively operate in the current environment. In these cases where the seller is serious about transacting, we are seeing pricing and cap rate adjustments that account for the increased cost of financing.

We will continue to target the strategies mentioned above while engaging with new and existing sponsors to evaluate investment opportunities. While we see the upside potential in many opportunities, we are aware of the increased downside risks stemming from rising rates and economic uncertainty. We remain disciplined in our underwriting, focusing on asset fundamentals and downside protection. Many business plans will not meet our criteria and we will be patient for the right risk/reward opportunities.

Like the rest of the industry, we are facing the near-term operating challenges discussed above in our existing portfolio. As owners, we recognize the window to sell assets at the significantly compressed cap rates we saw over the past few years has effectively closed. We therefore expect to hold most of our assets for the foreseeable future. In the meantime, we are actively working with our sponsor partners to grow and stabilize NOI and reserve liquidity, while remaining diligent in assessing the capital markets and exploring sales opportunities when they present themselves.