In this edition of Alpha Insights, we would like to invite a deeper discussion on the broader economic and commercial real estate landscape through our updated CRE whitepaper. We are also providing a brief update on our portfolio, including recent transactions.

The Current Commercial Real Estate Landscape

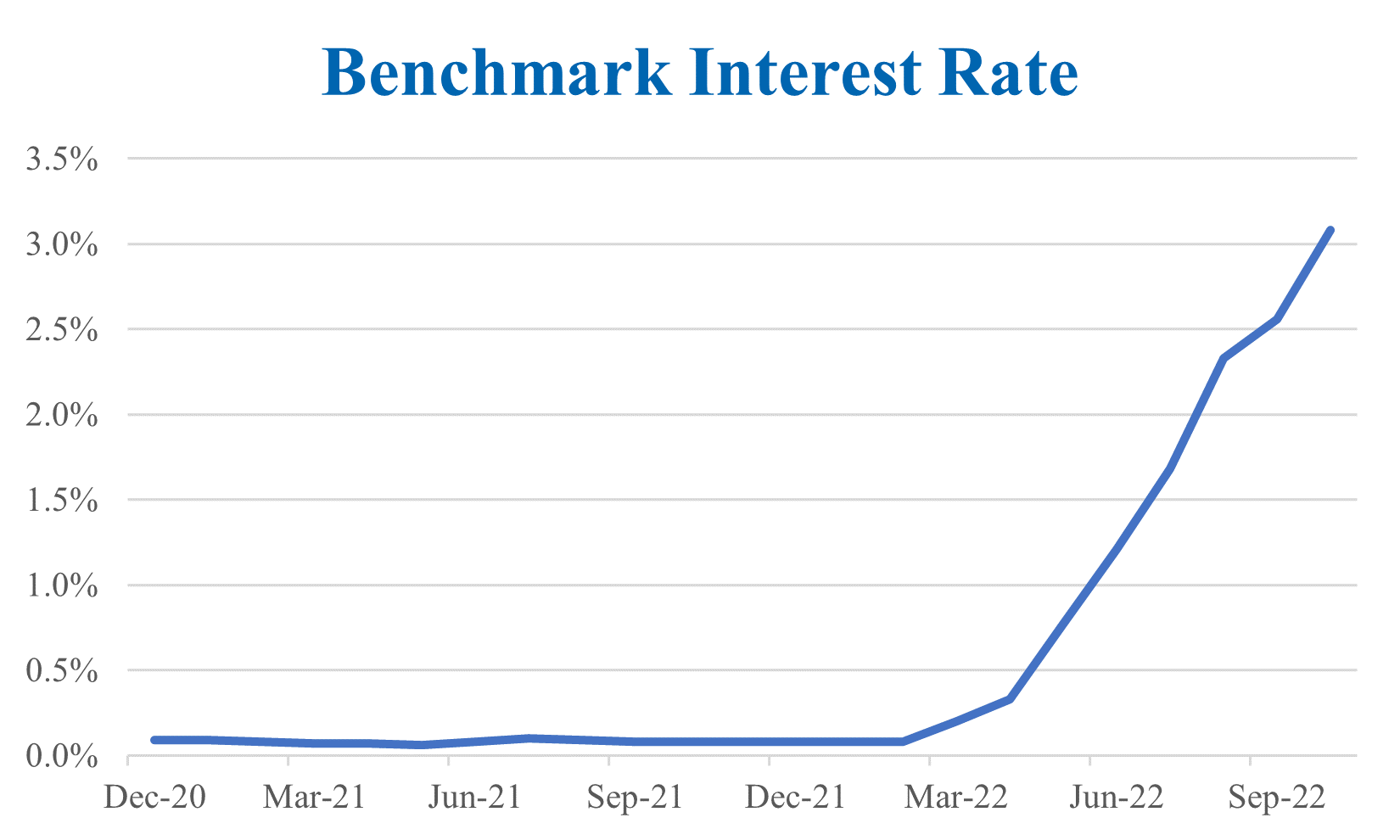

Higher interest rates are intended to cool demand to help rein in inflation. However, current inflationary pressures in large consumption categories, including shelter, energy, and food, are attributed more to supply-side disruptions versus excess demand. Therefore, raising interest rates alone may not solve the inflation problem, but might cause a slowdown in economic activity.

While rising interest rates have yet to have a material impact on taming inflation, the effects on housing and commercial real estate can already be seen. Home affordability hit its lowest point since the Great Recession in the second quarter of this year with just 42.8% of homes sold being affordable to families earning the US median income. In commercial real estate, rising interest rates have reduced current investor returns and caused cap rates to expand.

Alpha Investing continues to believe in the medium-to-long term fundamentals of investing in commercial real estate. However, we acknowledge that the near-term outlook has worsened due to the rapid rise in interest rates. Acquisitions in the current environment will need to have sound asset fundamentals, provide strong downside protection, and upside potential. Most opportunities today do not meet our criteria due to pricing and lack of adequate downside protection.

We continue to actively manage our existing portfolio and are focused on improving NOI quickly. We believe we can achieve outsized rent growth through targeted strategies that focus on opportunities specific to each individual investment to improve and stabilize yield. We will remain diligent in assessing the capital market environment for the opportune time to exit and maximize investor returns.